Capital One Bank has established itself as a leader in the financial services industry, offering a wide range of banking solutions tailored to meet the needs of customers across the United States. With its commitment to innovation and customer satisfaction, Capital One has become synonymous with trust and reliability. Whether you're looking to open a new account, manage your finances, or resolve specific issues, the Capital One Bank 1800 service provides seamless access to assistance and support.

As one of the largest banks in the U.S., Capital One offers a variety of products and services, including credit cards, loans, and savings accounts. The bank prides itself on delivering exceptional customer service, ensuring that clients receive the attention and care they deserve. Through its toll-free number, Capital One Bank 1800, customers can easily connect with trained professionals who are ready to assist with any inquiries or concerns.

This article delves into the world of Capital One Bank, focusing on its 1800 customer service line. We will explore the bank's history, its key offerings, and how the toll-free service enhances the customer experience. By the end of this guide, you'll have a deeper understanding of how Capital One Bank 1800 can help you manage your finances effectively.

Read also:You May Be Young But Keith Sweats Journey Is Inspiring

Table of Contents:

- Introduction to Capital One Bank

- History of Capital One Bank

- Key Services Offered by Capital One

- Capital One Bank 1800 Service

- Customer Support Features

- Benefits of Using Capital One Bank 1800

- Frequently Asked Questions

- Security Measures

- Tips for Effective Use

- Conclusion

Introduction to Capital One Bank

Capital One Bank is a prominent financial institution known for its innovative approach to banking. Established in 1994, the bank has grown to become one of the largest in the United States, serving millions of customers with a diverse range of financial products. The Capital One Bank 1800 service plays a crucial role in enhancing customer interactions, providing a direct line of communication for inquiries, support, and troubleshooting.

Why Choose Capital One?

Capital One stands out due to its focus on customer-centric solutions. The bank leverages cutting-edge technology to deliver personalized banking experiences, ensuring that each client receives tailored support. Whether you're opening a new account or seeking assistance with an existing one, the Capital One Bank 1800 service ensures that your needs are met efficiently and effectively.

History of Capital One Bank

Capital One Bank traces its origins back to 1994 when it was founded as a division of Signet Bank. Over the years, the bank has undergone significant growth and expansion, acquiring several financial institutions to enhance its service offerings. Today, Capital One is a Fortune 500 company, recognized for its leadership in the financial services sector.

Milestones in Capital One's Journey

- 1994 - Capital One is established as a division of Signet Bank.

- 1997 - Becomes an independent public company.

- 2005 - Acquires HSBC Finance Corporation, expanding its consumer finance operations.

- 2019 - Launches Capital One Cafés, offering customers a unique banking experience.

Key Services Offered by Capital One

Capital One Bank provides a comprehensive suite of financial products and services designed to cater to the needs of individuals and businesses alike. From credit cards and loans to savings accounts and investment opportunities, the bank ensures that customers have access to a wide array of options to manage their finances.

Popular Products

- Credit Cards - Featuring cashback rewards, travel benefits, and low-interest rates.

- Savings Accounts - Offering competitive interest rates and easy accessibility.

- Loans - Including personal loans, auto loans, and mortgage options.

Capital One Bank 1800 Service

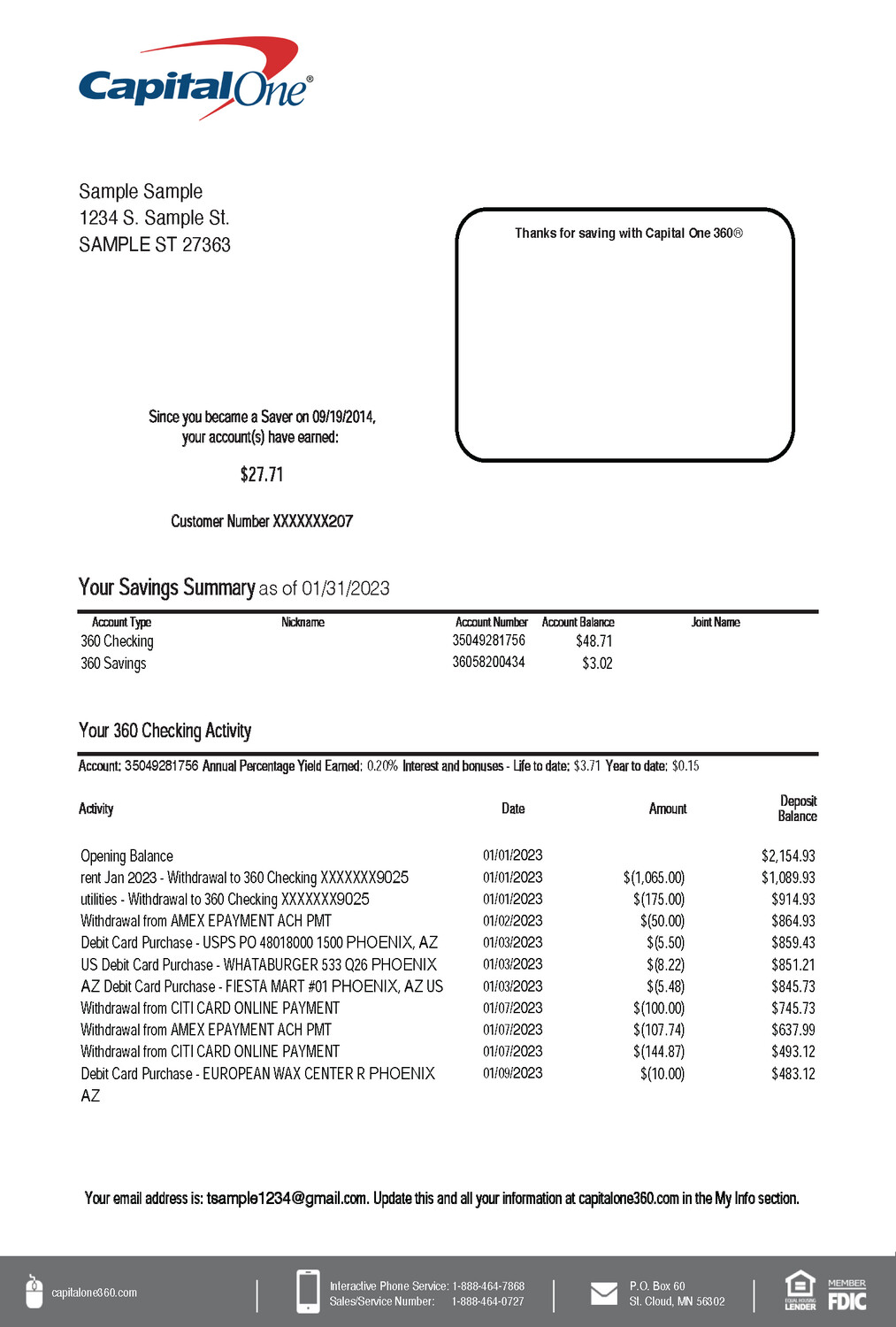

The Capital One Bank 1800 service is a dedicated toll-free line designed to assist customers with their banking needs. Whether you're seeking information about your account, reporting a lost card, or resolving a dispute, the 1800 service ensures that you receive prompt and professional support.

Read also:Dua Lipa Concert Dates Your Ultimate Guide To The Global Tour

How to Use the 1800 Service

To access the Capital One Bank 1800 service, simply dial the toll-free number provided on your account statements or the Capital One website. A team of trained professionals will guide you through the process, ensuring that your concerns are addressed in a timely manner.

Customer Support Features

Capital One Bank places a strong emphasis on customer satisfaction, offering a variety of support channels to assist clients. In addition to the 1800 service, customers can access online support, live chat, and mobile apps to manage their accounts conveniently.

Key Support Channels

- Phone Support - Available 24/7 via the Capital One Bank 1800 line.

- Online Chat - Provides real-time assistance through the Capital One website.

- Mobile App - Enables customers to manage their accounts on the go.

Benefits of Using Capital One Bank 1800

Utilizing the Capital One Bank 1800 service offers numerous advantages, ensuring that customers receive the support they need to manage their finances effectively. The service is designed to be user-friendly, accessible, and efficient, making it an invaluable resource for all Capital One clients.

Advantages of the 1800 Service

- 24/7 Availability - Access support whenever you need it.

- Trained Professionals - Speak with knowledgeable representatives.

- Secure Communication - Ensure the safety of your personal information.

Frequently Asked Questions

Many customers have questions about the Capital One Bank 1800 service. Below are some of the most common inquiries and their answers:

Common Questions

- Q: What services are available through the 1800 line?

- A: The 1800 line offers assistance with account inquiries, card services, and dispute resolution.

- Q: Is the 1800 service available 24/7?

- A: Yes, the Capital One Bank 1800 service is available around the clock.

Security Measures

Capital One Bank prioritizes the security of its customers' information, implementing robust measures to protect against fraud and unauthorized access. The 1800 service ensures that all communications are secure, safeguarding sensitive data.

Security Protocols

- Encryption Technology - Protects data transmitted over the phone.

- Two-Factor Authentication - Verifies user identity for added security.

Tips for Effective Use

To make the most of the Capital One Bank 1800 service, consider the following tips:

Best Practices

- Have your account information ready before calling.

- Be clear and concise when describing your issue.

- Utilize available resources, such as FAQs and online support.

Conclusion

In conclusion, the Capital One Bank 1800 service is an essential tool for customers seeking assistance with their banking needs. By providing round-the-clock support and expert guidance, Capital One ensures that clients receive the attention and care they deserve. We encourage you to take advantage of this service to manage your finances effectively.

We invite you to share your thoughts and experiences in the comments section below. Additionally, feel free to explore other articles on our website for more insights into the world of finance. Together, let's build a brighter financial future.

Data Source: Capital One Official Website