Long-term care insurance has become an essential financial tool for many individuals and families seeking security in uncertain times. As one of the leading providers in the industry, MetLife offers comprehensive long-term care solutions tailored to meet diverse needs. However, understanding how their customer service works and ensuring you get the best support can be challenging without proper guidance. This article aims to demystify MetLife's long-term care customer service, providing actionable insights and expert advice to help you navigate this critical aspect of your policy.

Whether you're a new policyholder or have been with MetLife for years, knowing how to access their customer service efficiently can significantly enhance your experience. From resolving claims to managing policy updates, MetLife's dedicated support team is ready to assist you every step of the way. In this article, we'll explore everything you need to know about MetLife long-term care customer service, including contact methods, troubleshooting tips, and strategies for maximizing your benefits.

By the end of this guide, you'll have a clear understanding of MetLife's long-term care offerings and how their customer service plays a pivotal role in ensuring your peace of mind. Let's dive in and uncover the secrets to a seamless experience with MetLife long-term care customer service.

Read also:Are Sweet Potatoes A Nightshade Plant Unveiling The Truth

Table of Contents

- About MetLife Long Term Care

- Overview of MetLife Long Term Care Customer Service

- Contact Options for MetLife Long Term Care

- Managing Your Long Term Care Policy

- Understanding the Claims Process

- Common Issues and Solutions

- Tips for Effective Customer Support

- MetLife's Trustworthiness and Reputation

- Customer Reviews and Testimonials

- Future Directions for MetLife Long Term Care

About MetLife Long Term Care

MetLife is a globally recognized insurance provider known for its innovative financial solutions. Their long-term care insurance program offers robust coverage options designed to cater to individuals and families seeking protection against the rising costs of extended medical care. With a focus on personalized service and customer satisfaction, MetLife has established itself as a leader in the long-term care insurance market.

Key Features of MetLife Long Term Care

Here are some standout features of MetLife's long-term care insurance:

- Comprehensive coverage options tailored to individual needs.

- Flexible payment plans to suit various budgets.

- Expert guidance from dedicated financial advisors.

- 24/7 customer support for policyholders and beneficiaries.

Overview of MetLife Long Term Care Customer Service

MetLife's long-term care customer service is designed to provide policyholders with seamless assistance in managing their policies, filing claims, and addressing any concerns. The company prioritizes accessibility and responsiveness, ensuring that customers receive timely and accurate information whenever they reach out.

Service Highlights

Key aspects of MetLife's customer service include:

- Multi-channel support via phone, email, and online portals.

- Dedicated account managers for personalized assistance.

- Extensive resources, including FAQs and video tutorials.

Contact Options for MetLife Long Term Care

MetLife offers several ways to connect with their customer service team, making it easy for policyholders to get the help they need. Below are the primary contact options available:

Phone Support

For immediate assistance, policyholders can call MetLife's toll-free customer service number: (800) 638-5433. Operators are available 24/7 to address inquiries related to policy management, claims processing, and general support.

Read also:Az Secretary Of State Business Search A Comprehensive Guide To Finding And Verifying Arizona Businesses

Online Support

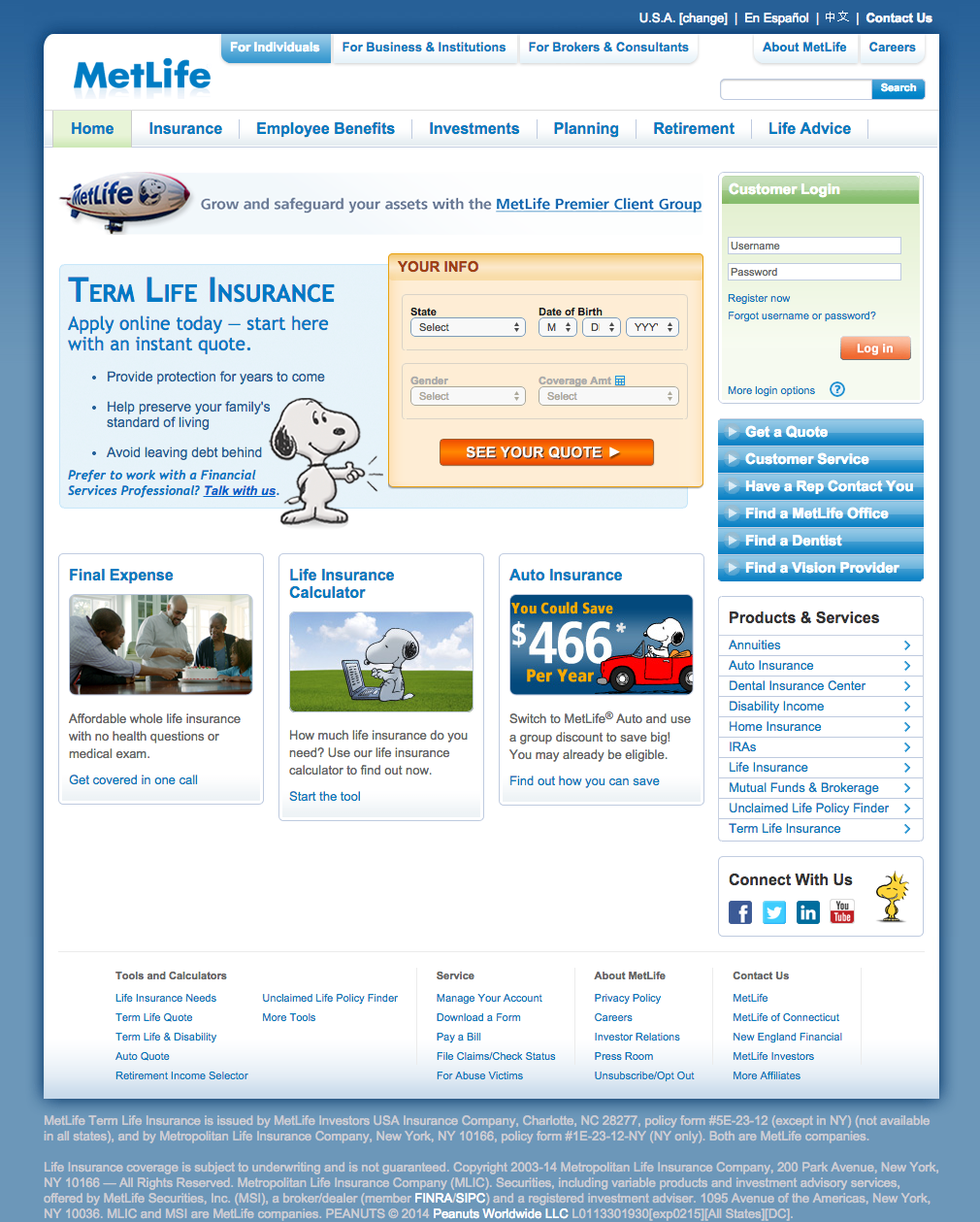

MetLife's official website provides a secure portal where customers can log in to view their policy details, update information, and submit claims. The website also features a live chat option for real-time support.

Email Support

For non-urgent matters, customers can send an email to customerservice@metlife.com. While response times may vary, MetLife strives to reply within 24-48 hours.

Managing Your Long Term Care Policy

Effectively managing your long-term care policy involves staying informed about its features and understanding how to utilize available resources. MetLife offers tools and services to simplify this process for policyholders.

Policy Review and Updates

Regularly reviewing your policy ensures that it aligns with your current needs. MetLife encourages policyholders to schedule annual reviews with their account managers to discuss any changes in circumstances or coverage requirements.

Online Tools

MetLife's online portal provides access to various tools, such as:

- Policy summary and history.

- Beneficiary designation updates.

- Payment history and schedule adjustments.

Understanding the Claims Process

Filing a claim for long-term care benefits can be a straightforward process if you follow MetLife's guidelines. Below is a step-by-step guide to navigating the claims process:

Step 1: Gather Required Documentation

Before submitting a claim, ensure you have all necessary documents, including medical records, proof of eligibility, and policy details.

Step 2: Submit Your Claim

Claims can be submitted via the MetLife website or by mailing the completed forms to the designated address. For faster processing, consider using the online portal.

Step 3: Follow Up

Once your claim is submitted, MetLife will review it and notify you of the decision within a specified timeframe. If additional information is needed, they will contact you promptly.

Common Issues and Solutions

Despite MetLife's commitment to quality service, policyholders may encounter challenges. Below are some common issues and their solutions:

Delayed Claims Processing

If your claim is taking longer than expected, contact MetLife's customer service team to inquire about its status. Providing any missing documentation can expedite the process.

Policy Misunderstandings

To avoid confusion, review your policy thoroughly and clarify any questions with your account manager. MetLife offers free consultations to ensure you fully understand your coverage.

Tips for Effective Customer Support

Maximizing your experience with MetLife's customer service requires proactive engagement. Here are some tips to help you get the most out of their support:

Document Your Interactions

Keep a record of all communications with MetLife, including dates, times, and details discussed. This documentation can be invaluable if disputes arise.

Utilize Available Resources

Take advantage of MetLife's extensive resources, such as webinars, guides, and support forums, to enhance your understanding of their services.

MetLife's Trustworthiness and Reputation

MetLife has earned a reputation for reliability and integrity in the insurance industry. Their commitment to customer satisfaction and financial stability makes them a trusted choice for long-term care insurance.

Industry Recognition

MetLife has received numerous awards and accolades for its excellence in service and innovation. These recognitions reflect their dedication to maintaining high standards of quality and trust.

Customer Reviews and Testimonials

Real feedback from MetLife's customers provides valuable insights into their experiences. Many policyholders praise the company for its responsive customer service and transparent processes.

Positive Feedback

Some common themes in positive reviews include:

- Efficient claims processing.

- Knowledgeable and friendly staff.

- Comprehensive policy options.

Future Directions for MetLife Long Term Care

As the demand for long-term care solutions continues to grow, MetLife is committed to evolving its offerings to meet changing needs. Future developments may include enhanced digital tools, expanded coverage options, and increased focus on preventive care.

Stay informed about MetLife's advancements by subscribing to their newsletters and updates. This ensures you're always aware of new features and benefits that could enhance your policy.

Kesimpulan

MetLife's long-term care customer service plays a crucial role in ensuring policyholders receive the support they need to navigate their insurance journey. By understanding the available resources and following best practices, you can maximize your experience with MetLife and secure a stable financial future.

We encourage you to share your thoughts and experiences in the comments below. Your feedback helps others make informed decisions about their long-term care needs. Additionally, explore other articles on our site for more insights into financial planning and insurance solutions.

Remember, your peace of mind is our priority. Contact MetLife today to learn more about their long-term care offerings and how they can benefit you.