Montana Department of Revenue plays a crucial role in the financial health of the state by managing tax policies and ensuring compliance among residents and businesses. This article delves into the inner workings of the department, offering insights into its services, regulations, and responsibilities. Whether you're a taxpayer, a business owner, or simply interested in understanding how revenue is managed in Montana, this guide is for you.

As one of the key government agencies in Montana, the Department of Revenue oversees various aspects of taxation, licensing, and revenue collection. Understanding its functions is essential for anyone seeking to navigate the state's financial landscape efficiently and legally.

This article provides an in-depth exploration of the Montana Department of Revenue, covering everything from its history and organizational structure to its current initiatives and future plans. By the end of this guide, you'll have a comprehensive understanding of how this department impacts both individuals and businesses in Montana.

Read also:Lord Of The Rings Complete Recordings A Comprehensive Guide

Table of Contents

- History of Montana Department of Revenue

- Organizational Structure and Roles

- Key Services Offered by the Department

- Understanding Montana Tax Policies

- Licensing and Registration Procedures

- Compliance and Enforcement Measures

- Resources for Taxpayers and Businesses

- Current Initiatives and Future Plans

- Statistical Insights on Revenue Collection

- Frequently Asked Questions

History of Montana Department of Revenue

The Montana Department of Revenue has a rich history that dates back to the early days of statehood. Established to manage the financial affairs of the state, the department has evolved significantly over the years to adapt to changing economic conditions and technological advancements.

Originally tasked with collecting property taxes and managing state-owned lands, the department gradually expanded its responsibilities to include income taxes, fuel taxes, and various other revenue-generating activities. This growth reflects Montana's commitment to maintaining a robust and equitable tax system.

Key Milestones in the Department's History

- 1919: The establishment of the Montana Department of Revenue as an independent agency.

- 1947: Introduction of the state income tax, marking a significant shift in revenue collection methods.

- 1990s: Adoption of digital systems for tax filing and payment, improving efficiency and accessibility.

Organizational Structure and Roles

The Montana Department of Revenue operates under a well-defined organizational structure designed to ensure efficient administration and oversight of tax policies. The department is divided into several divisions, each with specific responsibilities:

- Administrative Services Division: Handles budgeting, accounting, and human resources.

- Tax Division: Oversees the collection and administration of various taxes, including income, property, and sales taxes.

- Licensing Division: Manages the issuance and renewal of licenses for businesses and professionals.

This structure ensures that each division can focus on its core functions while collaborating with others to achieve the department's overall goals.

Key Services Offered by the Department

The Montana Department of Revenue provides a wide range of services to residents and businesses. These services are designed to facilitate compliance with tax laws and regulations while offering support and resources to taxpayers.

Services for Individuals

For individuals, the department offers assistance with:

Read also:Regal Movie Tickets Aaa Your Ultimate Guide To Exclusive Movie Experiences

- Filing income tax returns.

- Applying for property tax exemptions and credits.

- Understanding and paying sales and use taxes.

Services for Businesses

Businesses can benefit from the department's services, including:

- Registering for business licenses and permits.

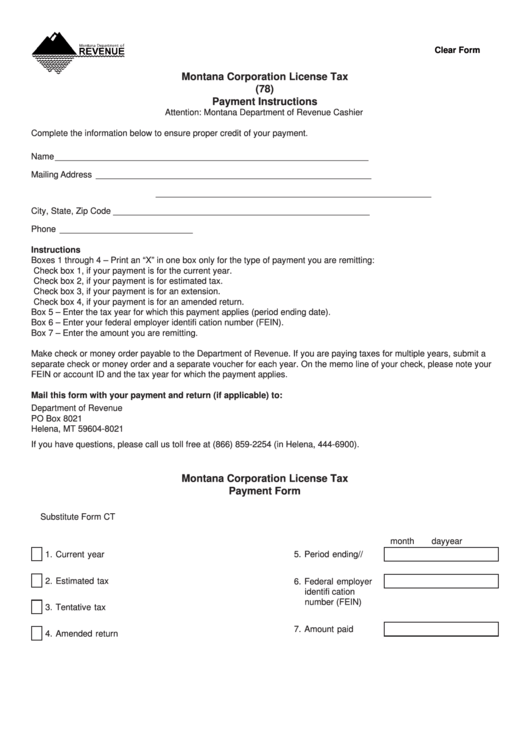

- Filing corporate income tax returns.

- Managing payroll and employment taxes.

Understanding Montana Tax Policies

Taxation is a critical aspect of the Montana Department of Revenue's operations. The state has a unique tax structure that includes income, property, and sales taxes, among others. Understanding these policies is essential for both individuals and businesses to ensure compliance and avoid penalties.

Income Tax

Montana's income tax system is progressive, with rates ranging from 1% to 6.9% depending on income levels. The department provides resources to help taxpayers calculate their liabilities and file their returns accurately.

Property Tax

Property taxes in Montana are based on assessed values and vary by jurisdiction. The department works closely with local governments to ensure fair and consistent assessments.

Licensing and Registration Procedures

Obtaining licenses and registrations is a necessary step for many businesses and professionals in Montana. The Montana Department of Revenue oversees these processes, ensuring that all requirements are met and fees are paid promptly.

To apply for a business license, applicants must submit the necessary documentation and pay any applicable fees. The department provides detailed guidelines and support to simplify this process.

Compliance and Enforcement Measures

Ensuring compliance with tax laws and regulations is a top priority for the Montana Department of Revenue. The department employs various measures to enforce compliance, including audits, penalties, and educational programs.

Audits are conducted periodically to verify the accuracy of tax filings and identify discrepancies. Penalties may be imposed for late filings or underreported income. However, the department also offers resources to educate taxpayers and help them avoid common mistakes.

Resources for Taxpayers and Businesses

The Montana Department of Revenue provides numerous resources to assist taxpayers and businesses in navigating the complexities of tax laws and regulations. These resources include online tools, publications, and customer service support.

- Online Tax Filing Portal: Allows taxpayers to file their returns electronically and track the status of their refunds.

- Educational Materials: Offers guides and tutorials on various tax topics, helping taxpayers understand their obligations.

- Customer Service: Provides phone and email support to address questions and concerns.

Current Initiatives and Future Plans

The Montana Department of Revenue is continuously working on initiatives to improve its services and enhance the taxpayer experience. Some of the current and future plans include:

- Expanding digital services to increase accessibility and convenience.

- Implementing new technologies to streamline processes and reduce errors.

- Enhancing educational programs to improve taxpayer awareness and compliance.

Statistical Insights on Revenue Collection

Data plays a vital role in understanding the effectiveness of the Montana Department of Revenue's operations. According to recent statistics:

- In 2022, the department collected over $2 billion in tax revenue.

- Income taxes accounted for approximately 40% of total revenue.

- Property taxes contributed around 35% to the state's revenue.

These figures highlight the department's success in generating revenue while maintaining compliance among taxpayers.

Frequently Asked Questions

Here are some common questions about the Montana Department of Revenue:

- What services does the Montana Department of Revenue offer? The department provides services such as tax filing assistance, licensing, and compliance support.

- How can I file my taxes online? You can use the department's online tax filing portal to submit your returns electronically.

- What happens if I miss the tax filing deadline? Late filings may result in penalties, but the department offers resources to help you catch up.

Conclusion

The Montana Department of Revenue is a vital component of the state's financial infrastructure, ensuring that tax policies are implemented fairly and efficiently. By understanding its functions, services, and initiatives, individuals and businesses can better navigate the complexities of taxation and licensing in Montana.

We encourage you to explore the department's resources and take advantage of the support available to ensure compliance and maximize your financial well-being. Share this article with others who may benefit from the information, and don't hesitate to leave a comment or question below. Together, we can foster a more informed and compliant community.

Data Sources:

- Montana Department of Revenue Official Website

- IRS Publications and Guidelines

- State of Montana Annual Reports