In today's digital age, online banking has become an essential tool for managing finances. Fifth Third Bank online offers a wide range of services that make banking convenient and accessible for customers. Whether you're managing accounts, making payments, or investing, Fifth Third Bank provides tools to simplify your financial life.

Fifth Third Bank has been a trusted financial institution for decades, serving individuals and businesses across the United States. The bank's online platform allows customers to access their accounts from anywhere, ensuring they have control over their finances at all times. With features like mobile banking, bill pay, and investment management, Fifth Third Bank online is a go-to solution for modern banking needs.

This article will explore the features, benefits, and security measures of Fifth Third Bank online. We'll also provide tips for optimizing your experience and ensuring your financial data remains secure. By the end of this guide, you'll have a comprehensive understanding of how to make the most of Fifth Third Bank's digital offerings.

Read also:Stone Cold Steve Austin Wwe Champion The Legends Journey To The Top

Table of Contents

- Introduction to Fifth Third Bank Online

- Benefits of Using Fifth Third Bank Online

- Key Features of Fifth Third Bank Online

- Security Measures in Fifth Third Bank Online

- Types of Accounts Available

- How to Enroll in Fifth Third Bank Online

- Fifth Third Bank Mobile App

- Customer Support for Fifth Third Bank Online

- Tips for Using Fifth Third Bank Online

- Conclusion

Introduction to Fifth Third Bank Online

Fifth Third Bank online is a digital platform that enables customers to manage their finances effortlessly. The platform offers a variety of tools and services designed to meet the needs of both individual and business customers. Whether you're checking your account balance, transferring funds, or applying for a loan, Fifth Third Bank online provides a seamless experience.

With over 150 years of experience in the banking industry, Fifth Third Bank has established itself as a reliable financial institution. The bank's commitment to innovation ensures that its online platform remains up-to-date with the latest technology and security standards. This dedication to quality makes Fifth Third Bank online a trusted choice for millions of customers.

History of Fifth Third Bank

Fifth Third Bank was founded in 1858 in Cincinnati, Ohio. Over the years, the bank has grown to become one of the largest financial institutions in the United States. Its online platform reflects the bank's long-standing tradition of providing exceptional service to its customers. By leveraging technology, Fifth Third Bank continues to enhance its offerings and improve the banking experience for its clients.

Benefits of Using Fifth Third Bank Online

Using Fifth Third Bank online offers numerous advantages for customers. From convenience to cost savings, the platform provides a range of benefits that make banking easier and more efficient.

- Convenience: Access your accounts anytime, anywhere using a computer or mobile device.

- Time-Saving: Perform transactions quickly without visiting a physical branch.

- Cost Savings: Avoid fees associated with traditional banking methods, such as check processing.

- Security: Benefit from advanced security features to protect your financial information.

Convenience in Everyday Banking

One of the primary benefits of Fifth Third Bank online is the convenience it offers. Customers can manage their accounts from the comfort of their homes or while on the go. This flexibility ensures that you can stay on top of your finances regardless of your location or schedule.

Key Features of Fifth Third Bank Online

Fifth Third Bank online is packed with features that enhance the banking experience. These features are designed to meet the diverse needs of customers, from managing day-to-day transactions to planning for the future.

Read also:What To Do In Corpus Christi Your Ultimate Guide To Exploring The Coastal Charm

Account Management

With Fifth Third Bank online, you can easily manage your accounts. View balances, review transactions, and monitor your financial health in real-time. This feature allows you to stay informed about your financial situation and make data-driven decisions.

Bill Pay

Pay your bills online with ease using Fifth Third Bank's bill pay service. Schedule payments, set up recurring payments, and manage your expenses all in one place. This feature saves time and ensures that you never miss a payment deadline.

Investment Tools

Fifth Third Bank online offers a variety of investment tools to help you grow your wealth. Access market research, track your portfolio, and make informed investment decisions. These tools empower you to take control of your financial future.

Security Measures in Fifth Third Bank Online

Security is a top priority for Fifth Third Bank. The bank employs advanced security measures to protect customer data and ensure a safe banking experience. These measures include encryption, multi-factor authentication, and fraud detection tools.

Data Encryption

All data transmitted through Fifth Third Bank online is encrypted using industry-standard protocols. This ensures that your sensitive information remains secure while in transit. Encryption protects your data from unauthorized access and potential cyber threats.

Multi-Factor Authentication

To enhance security, Fifth Third Bank uses multi-factor authentication (MFA). This process requires users to provide two or more verification factors before accessing their accounts. MFA adds an extra layer of protection, making it more difficult for unauthorized users to gain access.

Types of Accounts Available

Fifth Third Bank offers a variety of account types to meet the needs of its customers. Whether you're looking for a checking account, savings account, or investment account, Fifth Third Bank has options to suit your financial goals.

Checking Accounts

Fifth Third Bank provides several checking account options, including free checking and premium checking accounts. These accounts offer features such as unlimited transactions, mobile check deposits, and access to a vast ATM network.

Savings Accounts

Save for your future with Fifth Third Bank's savings accounts. These accounts offer competitive interest rates and no monthly maintenance fees. With options like traditional savings and money market accounts, you can choose the account that best fits your needs.

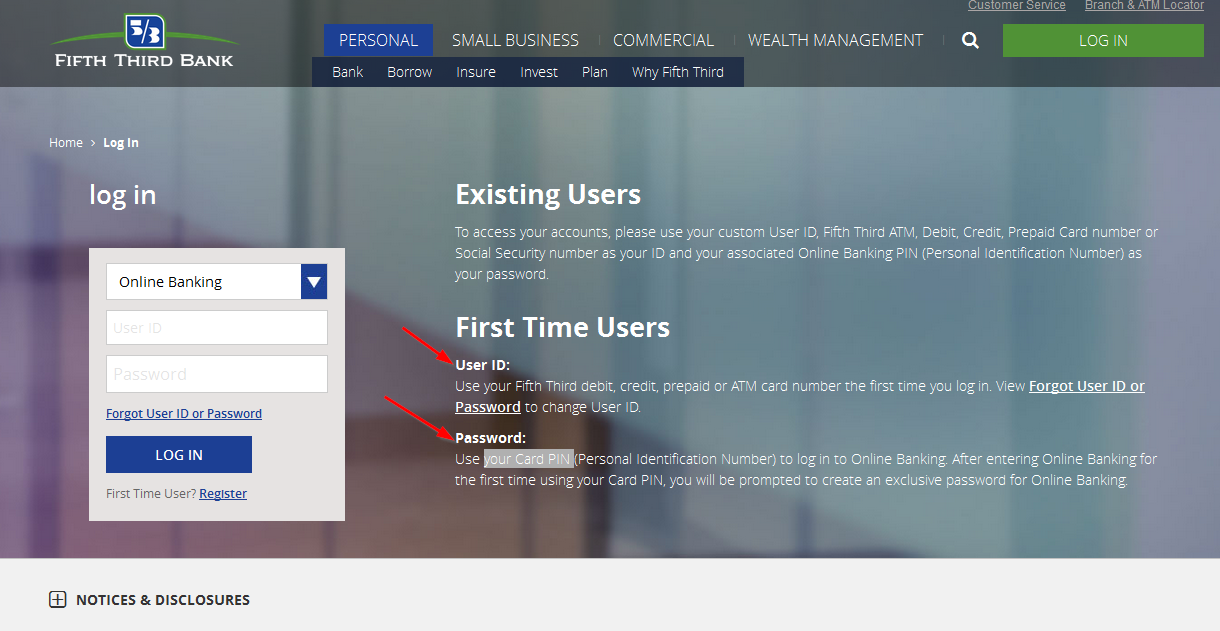

How to Enroll in Fifth Third Bank Online

Enrolling in Fifth Third Bank online is a simple process. Follow these steps to get started:

- Visit the Fifth Third Bank website and click on the "Enroll Now" button.

- Enter your account information and create a username and password.

- Verify your identity using the information provided during account setup.

- Complete the enrollment process and begin using Fifth Third Bank online.

Account Setup Tips

When setting up your Fifth Third Bank online account, consider the following tips:

- Use a strong, unique password to enhance security.

- Enable multi-factor authentication for added protection.

- Regularly update your security settings to ensure your account remains secure.

Fifth Third Bank Mobile App

Fifth Third Bank offers a mobile app that allows customers to access their accounts on the go. The app provides all the features of the online platform, including account management, bill pay, and investment tools. With the mobile app, you can manage your finances anytime, anywhere.

Mobile App Features

The Fifth Third Bank mobile app offers a range of features to enhance the banking experience:

- Account balance and transaction history

- Mobile check deposit

- Bill pay and money transfer

- Investment tracking and management

Customer Support for Fifth Third Bank Online

Fifth Third Bank provides excellent customer support to assist users with any issues they may encounter. The bank offers multiple channels for support, including phone, email, and live chat. These resources ensure that customers can get the help they need quickly and efficiently.

Live Chat Support

Live chat support is available for Fifth Third Bank online customers. This feature allows you to connect with a representative in real-time to resolve issues or answer questions. Live chat is a convenient and efficient way to get the support you need without waiting on hold.

Tips for Using Fifth Third Bank Online

To make the most of your Fifth Third Bank online experience, consider the following tips:

- Regularly monitor your account activity to detect any suspicious transactions.

- Set up alerts for important events, such as low balances or large transactions.

- Use the mobile app for on-the-go access to your accounts and features.

- Stay informed about the latest security measures and updates from Fifth Third Bank.

Maximizing Your Online Banking Experience

By following these tips, you can enhance your Fifth Third Bank online experience and ensure your financial data remains secure. Regularly reviewing your accounts and staying informed about the latest features will help you make the most of the platform.

Conclusion

Fifth Third Bank online offers a comprehensive suite of tools and services to meet the needs of modern banking customers. From account management to investment tools, the platform provides everything you need to manage your finances effectively. By leveraging advanced security measures and customer support, Fifth Third Bank ensures a safe and reliable banking experience.

We encourage you to explore the features of Fifth Third Bank online and take advantage of the benefits it offers. Don't hesitate to reach out to customer support if you have any questions or need assistance. Share your experience with others and help spread the word about the convenience and security of Fifth Third Bank online.