Direct deposit has become a popular and convenient method for receiving payments, especially with financial institutions like Chase. However, users occasionally encounter Chase direct deposit issues that can disrupt their financial flow. Whether it's delays, incorrect deposits, or technical glitches, understanding these problems is essential for resolving them quickly and efficiently.

As Chase continues to grow as a leading bank in the United States, the number of customers using its direct deposit services also increases. This rise in usage means that more individuals may face challenges related to their deposits. By gaining insights into common issues and learning how to troubleshoot them, you can ensure smoother transactions.

This article delves deep into Chase direct deposit issues, providing solutions and tips to help you avoid or address potential problems. From understanding the causes of delays to knowing how to contact Chase support, we cover everything you need to know. Let's explore the world of direct deposit and find practical solutions to common concerns.

Read also:Ethos Logos Pathos Commercials Unlocking The Power Of Persuasion

Table of Contents

- Introduction to Chase Direct Deposit

- Common Chase Direct Deposit Issues

- Causes of Delayed Deposits

- How to Check Your Direct Deposit Status

- Resolving Incorrect Deposit Problems

- Contacting Chase Support for Help

- Tips for Preventing Future Issues

- Understanding Chase Deposit Policies

- Frequently Asked Questions About Chase Direct Deposit

- Conclusion and Call to Action

Introduction to Chase Direct Deposit

Chase direct deposit is a secure and efficient way to receive payments directly into your Chase account. Employers and other payers can transfer funds electronically, eliminating the need for paper checks. This method offers several advantages, including faster access to funds, reduced risk of lost checks, and increased convenience.

Advantages of Using Chase Direct Deposit

Here are some key benefits of using Chase direct deposit:

- Speed: Funds are typically deposited on the scheduled payday, often faster than traditional checks.

- Security: Eliminates the risk of lost or stolen checks.

- Convenience: No need to visit a branch or ATM to deposit checks.

- Automation: Payments are processed automatically, ensuring consistency.

Setting Up Chase Direct Deposit

To set up Chase direct deposit, you'll need to provide your employer or payer with specific account details. This typically includes your routing number, account number, and possibly a voided check or a direct deposit form. Ensure that all information provided is accurate to avoid issues later on.

Common Chase Direct Deposit Issues

Despite its benefits, Chase direct deposit can sometimes encounter issues. Below are some of the most common problems users face:

Delayed Deposits

One of the most frequent concerns is delayed deposits. This can occur due to various reasons, such as incorrect account information, holidays, or system glitches. Understanding the causes of delays can help you take appropriate action to resolve them.

Incorrect Deposits

Another issue is incorrect deposits, where the wrong amount or duplicate payments are made. This can be frustrating and may require contacting Chase support to correct the error.

Read also:Dua Lipa Concert Dates Your Ultimate Guide To The Global Tour

System Errors

Occasionally, system errors can disrupt the direct deposit process. These issues are usually resolved by Chase's technical team, but it's important to know how to handle them if they occur.

Causes of Delayed Deposits

Delayed deposits can stem from several factors. Below, we explore the primary reasons behind these delays:

Inaccurate Account Information

Providing incorrect account details, such as a wrong routing or account number, can lead to delays. Always double-check the information you provide to your employer or payer.

Holidays and Banking Days

Bank holidays and weekends can affect the processing of direct deposits. Be aware of Chase's banking schedule to avoid confusion about when your funds will be available.

Technical Glitches

Temporary technical issues within Chase's system can also cause delays. While these are usually resolved quickly, they can be frustrating for users.

How to Check Your Direct Deposit Status

Checking the status of your Chase direct deposit is essential if you suspect an issue. Follow these steps to verify your deposit:

Using Chase Mobile App

Log in to your Chase account via the mobile app and review your recent transactions. Look for the deposit under "Pending" or "Completed" transactions.

Calling Chase Customer Service

If you cannot locate your deposit, contact Chase customer service for assistance. They can provide updates on the status of your direct deposit.

Resolving Incorrect Deposit Problems

Incorrect deposits can be frustrating, but there are steps you can take to resolve them:

Contacting Your Employer

Reach out to your employer's payroll department to confirm the details of your deposit. They may have made an error that needs correction.

Reporting the Issue to Chase

If the problem persists, report it to Chase. Provide them with all relevant information, including the date and amount of the incorrect deposit.

Contacting Chase Support for Help

Chase offers multiple channels for customer support, making it easy to get help with direct deposit issues:

Phone Support

Call Chase's customer service hotline to speak with a representative. They can assist with inquiries about your direct deposit.

Online Chat

Use Chase's online chat feature for quick support. This method is convenient and often resolves issues promptly.

Tips for Preventing Future Issues

To minimize the chances of encountering Chase direct deposit issues, consider the following tips:

- Verify Account Information: Double-check all details before submitting them to your employer.

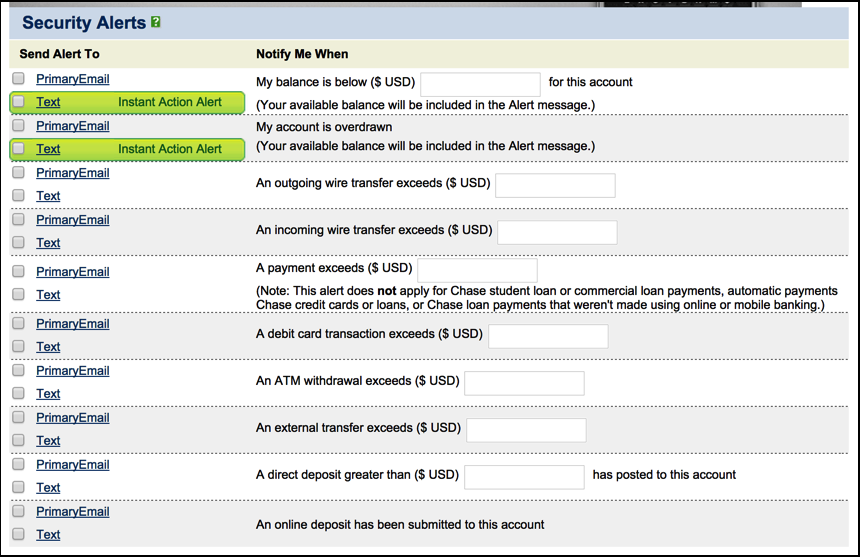

- Set Up Alerts: Enable transaction alerts to stay informed about your deposits.

- Stay Updated: Keep track of Chase's banking schedule to anticipate any delays.

Understanding Chase Deposit Policies

Knowing Chase's deposit policies can help you manage your expectations and avoid unnecessary stress:

Deposit Hold Policies

Chase may place holds on certain deposits, depending on their size or source. Understanding these policies can help you plan accordingly.

Processing Times

Learn about Chase's standard processing times to better anticipate when your funds will be available.

Frequently Asked Questions About Chase Direct Deposit

Below are answers to some common questions about Chase direct deposit:

How Long Does Chase Take to Process Direct Deposits?

Chase typically processes direct deposits within one business day. However, holidays and weekends may cause delays.

What Should I Do If My Deposit Is Missing?

Contact Chase customer service and your employer's payroll department to investigate the issue.

Conclusion and Call to Action

Chase direct deposit issues can be frustrating, but with the right knowledge and resources, they can be resolved efficiently. By understanding common problems, verifying account information, and staying informed about Chase's policies, you can minimize the risk of encountering issues.

We encourage you to share this article with others who may benefit from it. If you have any questions or experiences to share, feel free to leave a comment below. Additionally, explore our other articles for more insights into financial topics.