Capital One Credit Card customer service is an essential resource for cardholders who need assistance with their accounts. Whether you're trying to resolve an issue, activate your card, or inquire about rewards, knowing the right contact methods can make all the difference. In this article, we’ll explore everything you need to know about contacting Capital One Credit Card customer service.

As one of the leading financial institutions in the United States, Capital One offers a wide range of credit card options tailored to meet the needs of various customers. However, navigating the customer service process can sometimes be challenging without proper guidance. That’s why we’ve created this detailed guide to simplify your experience.

In addition to providing the Capital One Credit Card contact number, we’ll also cover alternative methods of communication, troubleshooting tips, and important information about their services. By the end of this article, you’ll be well-equipped to handle any situation that arises with your Capital One account.

Read also:Newark Terminal A Long Term Parking The Ultimate Guide For Travelers

Table of Contents

- Capital One Credit Card Overview

- Capital One Credit Card Contact Number

- Online Support and Resources

- Frequently Asked Questions

- Security Tips for Cardholders

- Troubleshooting Common Issues

- Capital One Credit Card Rewards Program

- Customer Experience and Feedback

- Contacting Capital One Internationally

- Conclusion and Next Steps

Capital One Credit Card Overview

History and Background

Capital One Financial Corporation was founded in 1988 and has since become one of the largest banks in the United States. Known for its innovative approach to banking and credit services, Capital One offers a variety of credit card products designed to cater to different consumer needs.

The company's mission is to provide simple, transparent financial products that help customers achieve their financial goals. With a strong focus on customer satisfaction, Capital One has consistently ranked high in customer service surveys.

Below is a summary of Capital One's key details:

| Company Name | Capital One Financial Corporation |

|---|---|

| Founded | 1988 |

| Headquarters | McLean, Virginia, USA |

| Website | www.capitalone.com |

Capital One Credit Card Contact Number

One of the most common questions asked by Capital One credit card users is, "What is the Capital One Credit Card contact number?" Fortunately, Capital One provides multiple phone numbers depending on the type of inquiry or issue you're facing.

The primary Capital One Credit Card customer service number is 1-800-CAPITAL (1-800-227-4825). This number is available 24/7 and can be used for general inquiries, account activation, and other services.

Here are some additional numbers you might find useful:

Read also:Where Is Terrence Crawford From Unveiling The Origins And Journey Of A Boxing Legend

- Lost or Stolen Card: 1-800-655-2273

- International Calls: +1-302-888-4771

- Business Credit Cards: 1-800-655-2263

Online Support and Resources

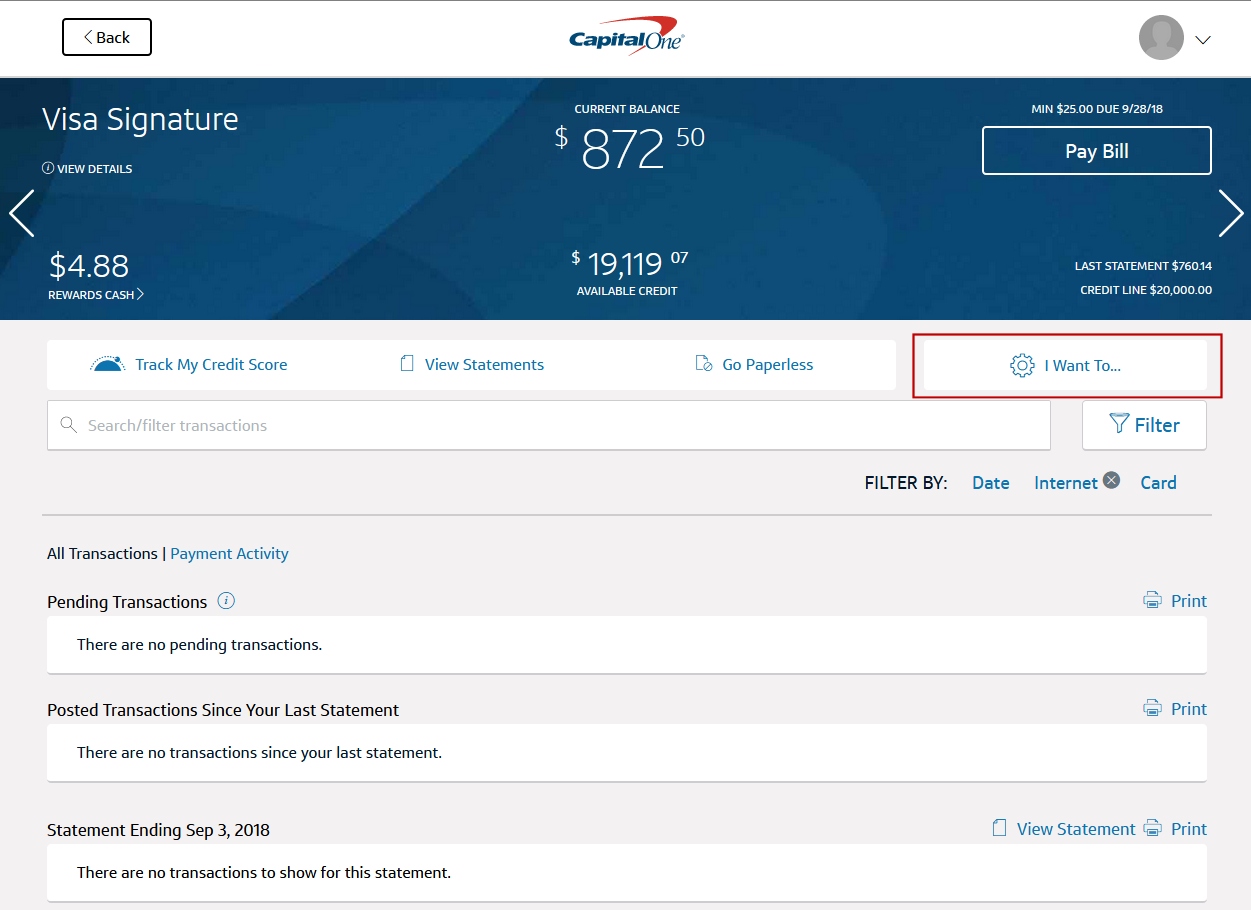

Accessing Your Account Online

In addition to phone support, Capital One offers robust online resources for managing your credit card account. You can access your account through the Capital One website or mobile app, where you can view transactions, pay bills, and manage settings.

To log in to your account online:

- Visit www.capitalone.com.

- Click on "Sign In" in the top-right corner.

- Enter your username and password.

Live Chat Support

For quick assistance, Capital One provides live chat support on their website. This feature allows you to communicate directly with a customer service representative without having to wait on hold.

To access live chat:

- Log in to your Capital One account.

- Click on the "Help" or "Support" option.

- Select "Live Chat" from the available options.

Frequently Asked Questions

How Do I Activate My Capital One Credit Card?

Activating your Capital One credit card is a straightforward process. You can activate your card using the following methods:

- Call the toll-free number printed on your card.

- Log in to your Capital One account online or through the mobile app.

- Follow the prompts to complete the activation process.

What Should I Do If My Card Is Lost or Stolen?

If your Capital One credit card is lost or stolen, it's important to act quickly to prevent unauthorized transactions. Here’s what you should do:

- Call the Capital One lost or stolen card hotline at 1-800-655-2273.

- Report the incident and request a replacement card.

- Monitor your account for any suspicious activity.

Security Tips for Cardholders

Protecting Your Personal Information

As a Capital One credit card user, it's crucial to safeguard your personal and financial information. Here are some tips to help you stay secure:

- Never share your account details or passwords with anyone.

- Use strong, unique passwords for your online accounts.

- Enable two-factor authentication for added security.

Recognizing Fraudulent Activity

Capital One employs advanced security measures to protect its customers from fraud. However, it's still important to remain vigilant and report any suspicious activity immediately. Signs of potential fraud include:

- Unrecognized transactions on your statement.

- Unusual account notifications or alerts.

- Unexpected changes to your account information.

Troubleshooting Common Issues

Resolving Payment Issues

Payment issues are among the most common problems encountered by credit card users. If you're experiencing difficulties with your Capital One credit card payments, try the following steps:

- Verify that your payment information is correct.

- Ensure that your account has sufficient funds or available credit.

- Contact Capital One customer service for further assistance.

Addressing Billing Disputes

If you notice an error on your Capital One credit card bill, you can dispute the charge by following these steps:

- Log in to your account and select the "Dispute a Charge" option.

- Provide details about the disputed transaction.

- Submit your dispute and wait for Capital One to investigate.

Capital One Credit Card Rewards Program

Capital One offers a variety of rewards programs designed to reward loyal customers. Depending on the type of card you hold, you may earn cash back, travel points, or other benefits. To learn more about your specific rewards program, visit the Capital One website or contact customer service.

Maximizing Your Rewards

To get the most out of your Capital One credit card rewards:

- Use your card for everyday purchases to accumulate points or cash back.

- Take advantage of special promotions or bonus categories.

- Redeem your rewards regularly to avoid losing them.

Customer Experience and Feedback

Capital One is committed to delivering exceptional customer service. According to recent surveys, the majority of Capital One credit card users report high levels of satisfaction with the company's support services.

However, as with any financial institution, there may be occasional issues or areas for improvement. If you have feedback or suggestions for Capital One, you can submit them through the company's official feedback channels.

Contacting Capital One Internationally

If you're traveling abroad or reside outside the United States, you can still reach Capital One customer service using the international dialing number: +1-302-888-4771. This number is available 24/7 and can be used to address any concerns related to your credit card account.

Conclusion and Next Steps

In conclusion, Capital One Credit Card customer service provides a wide range of resources and support options to assist cardholders with their accounts. From the Capital One Credit Card contact number to online tools and live chat support, there are multiple ways to get the help you need.

We encourage you to bookmark this guide for future reference and to share it with others who may find it useful. If you have any questions or feedback, please leave a comment below or explore other articles on our website for more information about Capital One and its services.

Take Action: Reach out to Capital One today using the contact methods provided and start managing your credit card account with confidence!