ABA, or the American Bankers Association, plays a pivotal role in shaping the financial sector. It acts as a unifying force that brings together banks and financial institutions to promote stability, growth, and innovation in the banking industry. By understanding ABA's role, you can gain valuable insights into the mechanisms that govern banking operations and regulatory compliance.

As the financial landscape evolves, staying informed about ABA's influence and its initiatives becomes essential for both professionals and consumers. This article will delve into the intricacies of ABA's functions, its historical significance, and how it impacts banking practices today. Whether you're a banking professional or simply curious about the industry, this guide will provide a thorough understanding of ABA's role in banking.

From regulatory frameworks to advocacy efforts, ABA's contributions to the banking sector are multifaceted. By exploring the various aspects of ABA's work, we aim to equip readers with the knowledge they need to navigate the complexities of modern banking. Let's dive into the details and uncover the importance of ABA in the banking world.

Read also:Famous People With Als Inspiring Stories And Their Legacy

Table of Contents

- Overview of ABA in Banking

- History and Formation of ABA

- Key Functions of ABA

- ABA's Role in Banking Regulations

- Advocacy Efforts by ABA

- Impact of Technology on ABA's Operations

- Benefits for ABA Members

- Challenges Faced by ABA

- Future Trends and ABA's Role

- Conclusion and Key Takeaways

Overview of ABA in Banking

ABA stands as a cornerstone of the banking industry, offering guidance, resources, and advocacy for financial institutions across the United States. The association works tirelessly to ensure that banks operate efficiently and comply with regulatory standards. By fostering collaboration among member banks, ABA strengthens the financial ecosystem and promotes economic growth.

In today's dynamic banking environment, ABA plays a crucial role in addressing emerging challenges and opportunities. Its efforts focus on enhancing customer experiences, improving operational efficiencies, and driving innovation within the banking sector. Through its various initiatives, ABA ensures that banks remain resilient and adaptable in an ever-changing financial landscape.

Key Features of ABA

- Provides a platform for banks to share insights and best practices.

- Advocates for policies that support the banking industry.

- Offers educational resources and training programs for banking professionals.

History and Formation of ABA

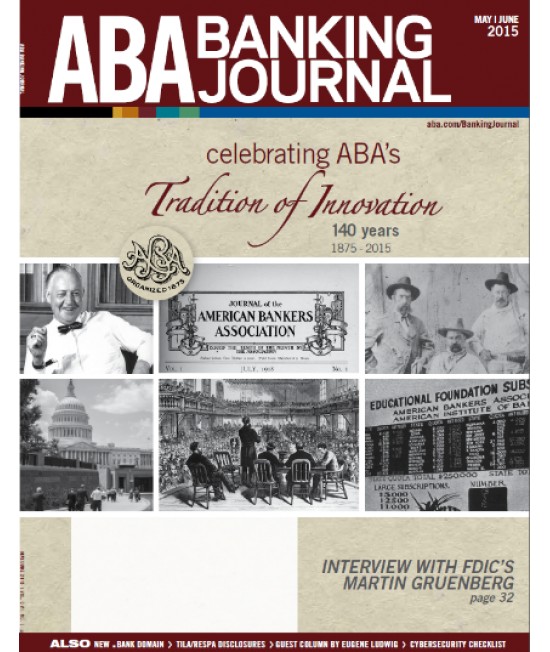

The American Bankers Association was founded in 1875 with the mission of representing the interests of banks and financial institutions. Over the years, ABA has grown to become one of the most influential organizations in the banking sector. Its rich history reflects the evolution of the financial industry and the association's commitment to supporting its members.

From its early days as a small group of bankers to its current status as a leading advocate for the banking industry, ABA has consistently adapted to meet the needs of its members. By staying ahead of industry trends and regulatory changes, ABA ensures that banks remain competitive and compliant.

Key Milestones in ABA's History

- 1875: Establishment of the American Bankers Association.

- 1930s: Advocacy for banking reforms during the Great Depression.

- 2000s: Expansion of digital banking initiatives and cybersecurity measures.

Key Functions of ABA

ABA performs a wide range of functions that benefit both member banks and the broader financial community. These functions include regulatory compliance, advocacy, education, and networking opportunities. By fulfilling these roles, ABA helps banks operate more effectively and efficiently.

One of ABA's primary functions is to provide resources and support for banks navigating complex regulatory environments. Additionally, the association offers educational programs and certifications for banking professionals, ensuring that they remain up-to-date with industry standards and best practices.

Read also:Florida Department Of Nursing A Comprehensive Guide To Advancing Your Nursing Career

Functions at a Glance

- Regulatory compliance assistance.

- Advocacy for banking policies.

- Education and certification programs.

ABA's Role in Banking Regulations

ABA plays a critical role in shaping banking regulations by working closely with government agencies and policymakers. The association provides input on proposed regulations and advocates for policies that support the banking industry. Through its regulatory efforts, ABA ensures that banks can operate in a fair and competitive environment.

ABA's involvement in regulatory matters extends beyond advocacy. The association also offers resources and guidance to help banks comply with complex regulations. By staying informed about regulatory developments, banks can better prepare for changes and avoid potential compliance issues.

Regulatory Focus Areas

- Consumer protection laws.

- Data privacy and cybersecurity regulations.

- Anti-money laundering (AML) requirements.

Advocacy Efforts by ABA

Advocacy is a cornerstone of ABA's mission, as the association strives to protect the interests of banks and financial institutions. Through its advocacy efforts, ABA promotes policies that support the banking industry and its customers. This includes lobbying for favorable legislation and engaging with policymakers to address industry concerns.

ABA's advocacy work also involves educating the public about the importance of banking services and the role they play in the economy. By raising awareness about these issues, ABA helps build support for policies that benefit the banking sector.

Advocacy Strategies

- Lobbying for pro-banking legislation.

- Engaging with policymakers on key issues.

- Public education campaigns about banking services.

Impact of Technology on ABA's Operations

The rapid advancement of technology has significantly impacted ABA's operations and the banking industry as a whole. ABA recognizes the importance of embracing digital transformation and encourages its members to adopt innovative solutions. From fintech partnerships to cybersecurity measures, ABA supports banks in leveraging technology to enhance their services.

ABA also plays a vital role in addressing the challenges posed by technological advancements, such as data security and privacy concerns. By providing guidance and resources, ABA helps banks navigate the complexities of the digital age and ensure that their operations remain secure and efficient.

Technology Initiatives

- Fintech partnerships and collaborations.

- Cybersecurity best practices and resources.

- Digital transformation strategies for banks.

Benefits for ABA Members

Becoming a member of ABA offers numerous benefits for banks and financial institutions. These benefits include access to exclusive resources, networking opportunities, and advocacy support. By joining ABA, banks can enhance their operations and stay informed about industry developments.

ABA members also enjoy educational opportunities, such as conferences, workshops, and certification programs. These resources help banking professionals develop their skills and stay competitive in the evolving financial landscape.

Member Benefits

- Access to exclusive resources and networking events.

- Advocacy support and representation.

- Educational programs and certifications.

Challenges Faced by ABA

Despite its many successes, ABA faces several challenges in today's rapidly changing financial environment. These challenges include adapting to new technologies, addressing regulatory complexities, and maintaining member engagement. By tackling these issues head-on, ABA can continue to serve as a valuable resource for the banking industry.

Another challenge for ABA is ensuring that its advocacy efforts remain effective in a politically charged climate. By building strong relationships with policymakers and stakeholders, ABA can continue to influence legislative outcomes and promote policies that benefit the banking sector.

Key Challenges

- Adapting to technological advancements.

- Navigating complex regulatory environments.

- Maintaining member engagement and support.

Future Trends and ABA's Role

As the banking industry continues to evolve, ABA will play a vital role in shaping its future. Emerging trends such as digital banking, artificial intelligence, and blockchain technology will require ABA to adapt and innovate in order to remain relevant. By staying ahead of these trends, ABA can continue to provide value to its members and the broader financial community.

Looking ahead, ABA's focus will likely shift toward fostering collaboration between traditional banks and fintech companies. This collaboration can lead to innovative solutions that benefit consumers and enhance the overall banking experience. By embracing these changes, ABA can ensure that the banking industry remains vibrant and resilient in the years to come.

Future Focus Areas

- Digital banking and fintech partnerships.

- Artificial intelligence and automation in banking.

- Blockchain and distributed ledger technologies.

Conclusion and Key Takeaways

In conclusion, ABA plays a crucial role in the banking industry by providing guidance, resources, and advocacy for financial institutions. Its efforts to promote stability, innovation, and compliance help ensure that banks can operate effectively in an ever-changing financial landscape. By understanding ABA's functions and initiatives, you can gain valuable insights into the mechanisms that govern the banking sector.

We encourage readers to explore ABA's resources and consider joining the association to benefit from its many advantages. Additionally, we invite you to share this article with others who may find it informative and engaging. Together, we can continue to support the growth and development of the banking industry.

Call to Action

- Join ABA to access exclusive resources and networking opportunities.

- Stay informed about industry trends and regulatory developments.

- Engage with ABA's advocacy efforts to support the banking sector.

For further reading, please refer to the following sources:

![ABA Banking Industry Response List Review cat[&]tonic](https://cat-tonic.com/wp-content/uploads/may20FD01_blog_image.jpg)