The United States debt clock has become a significant topic of discussion in recent years. It represents the total outstanding federal debt, which includes both public and intragovernmental debt. This growing figure raises concerns about the country's economic stability and future financial health. In this article, we will explore the intricacies of the U.S. debt clock and its implications.

The debt clock in the United States serves as a visual representation of the nation's financial obligations. It is a powerful reminder of the importance of fiscal responsibility and sustainable economic policies. By understanding the factors contributing to this growing debt, we can better grasp the challenges facing the U.S. economy.

As the debt continues to rise, many are questioning the long-term effects on the economy, interest rates, and the country's ability to meet future obligations. This article will delve into the details of the U.S. debt clock, its historical context, and the potential consequences of a growing national debt.

Read also:What Time Do The Rays Play Your Ultimate Guide To Tampa Bay Rays Game Schedule

What is the Debt Clock United States?

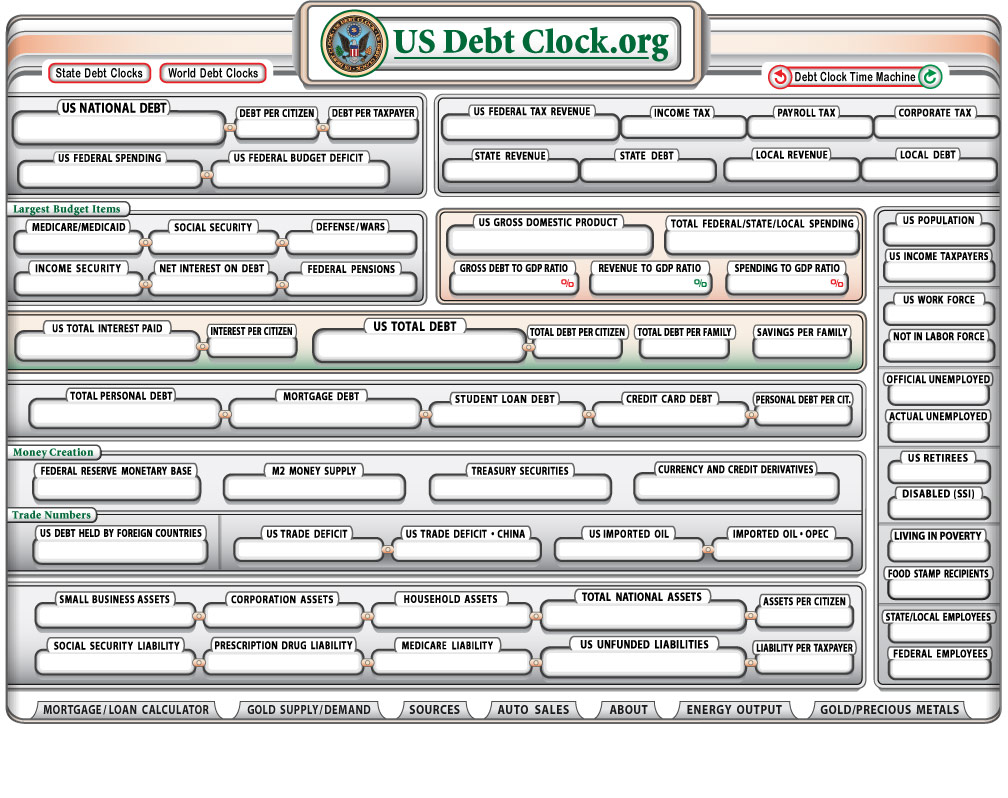

The debt clock United States refers to a real-time digital display showing the total outstanding federal debt of the United States. This figure includes both debt held by the public and intragovernmental holdings. The clock is a powerful symbol of the nation's financial health and serves as a constant reminder of the importance of fiscal discipline.

Components of the U.S. National Debt

The U.S. national debt comprises two main components:

- Debt held by the public: This includes bonds, bills, and notes sold to investors, including foreign governments, individuals, and institutions.

- Intragovernmental debt: This represents money owed by one part of the government to another, such as the Social Security Trust Fund.

Understanding these components is essential to comprehending the full scope of the nation's financial obligations.

History of the U.S. Debt Clock

The concept of the debt clock dates back to the early 1980s when it was first installed in New York City. It was created by Seymour Durst, a real estate developer, to highlight the growing national debt. Over the years, the debt clock has become a symbol of the nation's financial challenges.

Key Milestones in the Growth of the U.S. Debt

Several key milestones mark the growth of the U.S. national debt:

- 1980s: The debt began to rise significantly during the Reagan administration due to tax cuts and increased military spending.

- 2000s: The debt surged following the 2008 financial crisis, with the government implementing stimulus packages and bailouts.

- 2020s: The COVID-19 pandemic led to unprecedented government spending, further increasing the national debt.

These milestones illustrate the various factors contributing to the nation's growing financial burden.

Read also:The Lost Chord Song A Timeless Melody That Touches Hearts

Causes of the Rising U.S. National Debt

Several factors contribute to the rising national debt in the United States. These include:

- Fiscal policy decisions: Tax cuts, increased government spending, and budget deficits all contribute to the growth of the national debt.

- Economic downturns: Recessions and financial crises often lead to increased government spending to stabilize the economy.

- Demographic changes: An aging population places additional strain on programs like Social Security and Medicare, increasing government obligations.

Addressing these factors is crucial to managing the nation's financial health.

Impact of the U.S. Debt Clock on the Economy

The growing national debt has several potential impacts on the U.S. economy:

Interest Rates

As the national debt increases, the government may need to issue more bonds to finance its obligations. This can lead to higher interest rates, making borrowing more expensive for businesses and consumers.

Government Spending

A growing debt burden can limit the government's ability to invest in critical areas such as infrastructure, education, and healthcare. This may hinder long-term economic growth and development.

Global Perception

A high national debt can affect the country's credit rating and global perception, potentially leading to reduced investor confidence and increased borrowing costs.

Solutions to Address the U.S. National Debt

Several strategies can be employed to address the growing national debt:

- Fiscal reforms: Implementing policies to reduce budget deficits and improve fiscal discipline.

- Economic growth: Promoting policies that foster economic growth, increasing tax revenues and reducing the debt-to-GDP ratio.

- Entitlement reform: Addressing the long-term sustainability of programs like Social Security and Medicare.

Implementing these solutions requires a comprehensive approach and bipartisan cooperation.

Comparing the U.S. Debt Clock with Other Countries

The United States is not alone in facing a growing national debt. Many countries around the world are grappling with similar challenges. However, the U.S. debt clock stands out due to its sheer size and the country's role as a global economic leader.

Debt-to-GDP Ratios

A common metric for comparing national debts is the debt-to-GDP ratio. The U.S. debt-to-GDP ratio has been increasing in recent years, surpassing 100% in 2020. This figure is comparable to other major economies, such as Japan and Greece, but higher than countries like Germany and Canada.

Public Perception and Political Debate

The U.S. debt clock has become a focal point of political debate, with differing opinions on how to address the issue. Some argue for immediate action to reduce the debt, while others prioritize economic recovery and growth.

Partisan Divide

Political parties often have differing views on fiscal policy and the appropriate level of government spending. This divide can complicate efforts to implement comprehensive debt reduction strategies.

Future Prospects and Challenges

The future of the U.S. debt clock depends on a variety of factors, including economic growth, fiscal policy decisions, and global economic conditions. Addressing the growing national debt will require a combination of short-term and long-term strategies.

Long-Term Implications

If left unchecked, the growing national debt could have significant long-term implications for the U.S. economy, including reduced economic growth, higher interest rates, and decreased global competitiveness.

Conclusion

In conclusion, the debt clock United States serves as a powerful reminder of the nation's financial obligations and the challenges facing the economy. Understanding the causes and impacts of the growing national debt is essential to developing effective solutions. We encourage readers to engage in discussions about fiscal responsibility and to explore additional resources for further information.

Take action by sharing this article with others and continuing the conversation about the importance of addressing the U.S. national debt. Together, we can work towards a more sustainable financial future for the nation.

Table of Contents

- What is the Debt Clock United States?

- History of the U.S. Debt Clock

- Causes of the Rising U.S. National Debt

- Impact of the U.S. Debt Clock on the Economy

- Solutions to Address the U.S. National Debt

- Comparing the U.S. Debt Clock with Other Countries

- Public Perception and Political Debate

- Future Prospects and Challenges

- Conclusion