Hawaii, often regarded as a paradise on Earth, is one of the most sought-after destinations in the world. However, living in this tropical haven comes with a unique set of financial considerations. The cost of living in Hawaii is significantly higher compared to the mainland United States, and understanding the expenses associated with residing here is crucial for anyone planning a move or a long-term stay. In this article, we will explore the various factors that contribute to the high cost of living in Hawaii and provide actionable insights to help you plan accordingly.

Hawaii's appeal lies in its breathtaking landscapes, vibrant culture, and year-round sunshine. However, the state's isolation and reliance on imports make it one of the most expensive places to live in the U.S. From housing to groceries, transportation, and healthcare, every aspect of daily life comes with a premium price tag. This article aims to break down these costs and offer a clear picture of what to expect when living in Hawaii.

Whether you're considering a permanent move or simply curious about the financial realities of island life, this guide will equip you with the knowledge you need to make informed decisions. Let's dive into the details and uncover the true cost of living in Hawaii.

Read also:Discover The Allure Of Mountain Heart Flagstaff Az

Table of Contents:

- Introduction to Hawaii's Cost of Living

- Housing Costs in Hawaii

- Grocery Expenses

- Transportation Costs

- Healthcare Expenses

- Utilities and Internet

- Education Costs

- Entertainment and Leisure

- Taxes in Hawaii

- Tips for Managing Costs

- Conclusion

Introduction to Hawaii's Cost of Living

Hawaii's cost of living is a topic of great interest for both tourists and potential residents. The state's unique geography and economy contribute significantly to its high expenses. As an island chain in the middle of the Pacific Ocean, Hawaii faces logistical challenges that increase the cost of goods and services. For instance, nearly everything from construction materials to food items must be imported, driving up prices.

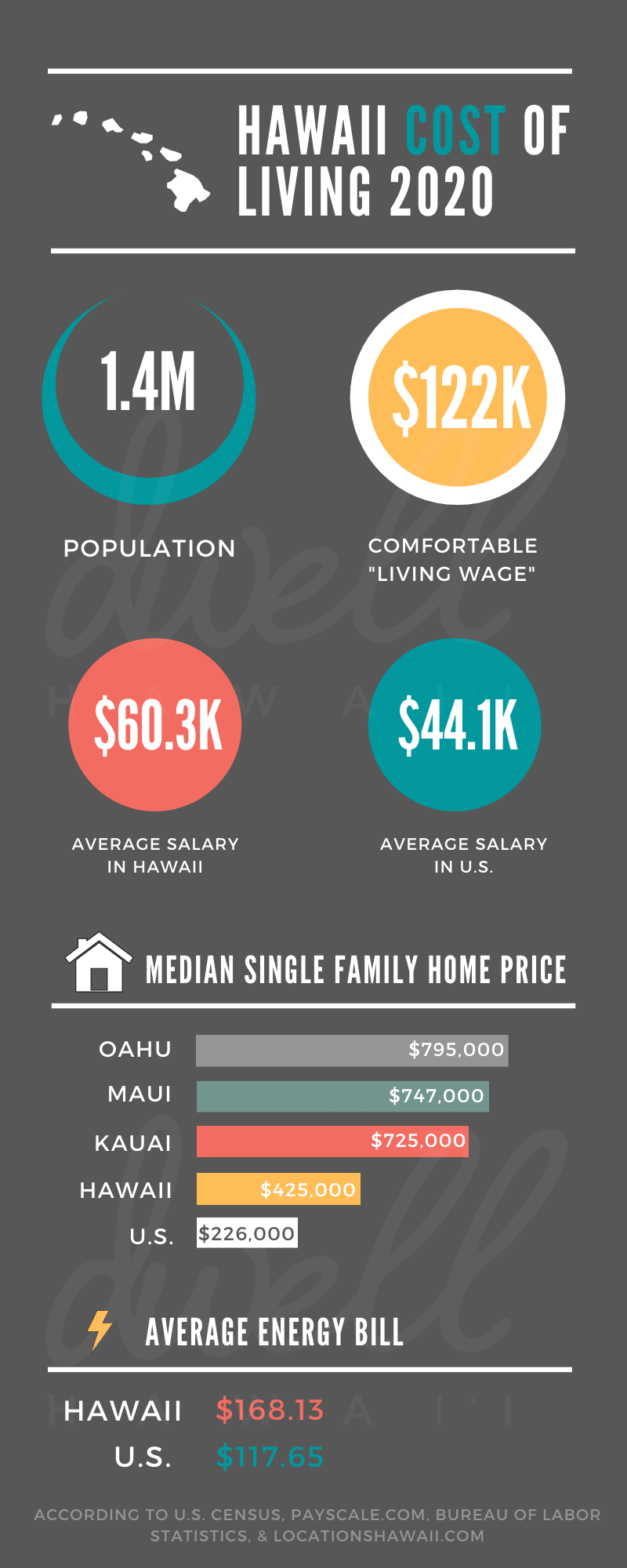

The cost of living in Hawaii is approximately 60% higher than the national average, according to data from the U.S. Bureau of Labor Statistics. This disparity is especially noticeable in major cities like Honolulu, where housing and transportation expenses are among the highest in the country. However, it's important to note that the cost of living can vary significantly depending on the island and location you choose to reside in.

Housing Costs in Hawaii

Housing is one of the most significant contributors to the high cost of living in Hawaii. The real estate market in the state is competitive, with limited land availability and high demand driving prices upward. As of 2023, the median home price in Hawaii is around $800,000, which is nearly double the national average.

Factors Influencing Housing Costs

Several factors influence housing costs in Hawaii:

- Location: Prices vary widely depending on the island and specific neighborhood. For example, homes in Oahu's urban areas are significantly more expensive than those in rural parts of Maui or the Big Island.

- Supply and Demand: The limited availability of land and high demand from both locals and tourists contribute to rising property values.

- Tourism Impact: The tourism industry drives up rental prices, as many property owners prefer to rent out their homes through short-term platforms like Airbnb.

According to Zillow, the average rent for a one-bedroom apartment in Honolulu is approximately $2,500 per month, making it one of the most expensive rental markets in the U.S.

Read also:Social Security Administration Office Philadelphia Pa Your Guide To Benefits And Services

Grocery Expenses

Grocery costs in Hawaii are another major expense due to the state's reliance on imports. Most food items are shipped or flown in from the mainland, which adds to the overall cost. On average, residents of Hawaii spend about 30% more on groceries than the national average.

Tips for Managing Grocery Costs

Here are some strategies to help you save money on groceries in Hawaii:

- Buy Local: Support local farmers and fishermen by purchasing fresh produce and seafood directly from farmers' markets or co-ops.

- Plan Meals: Create a weekly meal plan and stick to a shopping list to avoid impulse buys.

- Shop in Bulk: Consider purchasing non-perishable items in bulk to save money in the long run.

Transportation Costs

Transportation is another area where residents of Hawaii face higher expenses. The state's public transportation system is limited, especially outside of Honolulu, which means many people rely on personal vehicles. Gas prices in Hawaii are among the highest in the nation due to import costs and taxes.

Alternative Transportation Options

While owning a car is convenient, there are alternative transportation options to consider:

- Public Transit: The Honolulu Bus system provides affordable transportation around the city.

- Biking and Walking: Many areas in Hawaii are bike-friendly, offering scenic routes for those who prefer an eco-friendly mode of transportation.

- Carpooling: Joining a carpool group can help reduce fuel costs and minimize traffic congestion.

Healthcare Expenses

Healthcare costs in Hawaii are relatively lower compared to other states, thanks to the state's unique healthcare system. The Hawaii Prepaid Health Care Act mandates that employers provide health insurance coverage for their employees, ensuring that most residents have access to affordable healthcare.

Challenges in Healthcare

Despite these benefits, there are still challenges to consider:

- Specialist Availability: Some medical specialties may have limited availability, requiring residents to travel to the mainland for specialized care.

- Insurance Premiums: While coverage is mandatory, insurance premiums can still be a significant expense for some families.

Utilities and Internet

Utilities in Hawaii, including electricity, water, and internet, are also more expensive than the national average. The state's reliance on imported fossil fuels contributes to high electricity costs, with rates nearly three times higher than the mainland U.S.

Saving on Utilities

Here are some tips to help you reduce utility expenses:

- Energy Efficiency: Invest in energy-efficient appliances and lighting to lower electricity usage.

- Solar Power: Consider installing solar panels to harness Hawaii's abundant sunshine and reduce electricity bills.

- Water Conservation: Implement water-saving practices, such as fixing leaks and using low-flow fixtures.

Education Costs

Hawaii's public education system is well-regarded, offering free schooling for residents. However, private school tuition can be prohibitively expensive, with annual fees ranging from $8,000 to $20,000 per student. For higher education, the University of Hawaii system provides affordable tuition rates for state residents.

Financial Aid Options

Students pursuing higher education in Hawaii can explore various financial aid options:

- Scholarships: Apply for scholarships offered by the university and external organizations.

- Grants: Take advantage of federal and state grants that do not need to be repaid.

- Work-Study Programs: Participate in work-study programs to earn money while gaining valuable experience.

Entertainment and Leisure

Entertainment and leisure activities in Hawaii offer a unique blend of cultural experiences and outdoor adventures. From visiting historical sites to exploring natural wonders, there is no shortage of things to do. However, some activities, such as attending concerts or dining out, can be costly.

Affordable Leisure Activities

Here are some budget-friendly ways to enjoy Hawaii:

- Beach Days: Spend a day at one of Hawaii's beautiful beaches, which are free and open to the public.

- Hiking Trails: Discover the island's natural beauty by hiking on scenic trails.

- Cultural Events: Attend free or low-cost cultural events hosted by local communities.

Taxes in Hawaii

Taxes in Hawaii include general excise tax (GET), which applies to most goods and services, and real property tax, which varies depending on the property's location and value. While the state does not have a sales tax, the GET is often passed on to consumers, effectively increasing the cost of purchases.

Understanding Hawaii's Tax Structure

Here are some key points about Hawaii's tax system:

- Income Tax: Hawaii's income tax rates are progressive, with higher earners paying a larger percentage of their income.

- Estate Tax: The state imposes an estate tax on inheritances exceeding a certain threshold.

- Tax Credits: Residents can take advantage of various tax credits to reduce their tax burden.

Tips for Managing Costs

Living in Hawaii can be expensive, but there are ways to manage your expenses and enjoy the island lifestyle without breaking the bank. Here are some practical tips:

- Set a Budget: Create a detailed budget to track your income and expenses, ensuring you stay within your financial means.

- Seek Discounts: Look for discounts and coupons for groceries, entertainment, and other services.

- Build an Emergency Fund: Save money for unexpected expenses, such as car repairs or medical emergencies.

- Network with Locals: Connect with other residents to learn about affordable resources and hidden gems in the community.

Conclusion

The cost of living in Hawaii is undoubtedly higher than in most other parts of the U.S., but the state's unique charm and quality of life make it a worthwhile investment for many. By understanding the various factors that contribute to these expenses and implementing cost-saving strategies, you can make the most of your time in the Aloha State. We encourage you to share your thoughts and experiences in the comments below or explore other articles on our site to learn more about Hawaii's lifestyle and culture.

Thank you for reading, and mahalo for considering Hawaii as your home!