The United States National Debt Clock has become a focal point for discussions about fiscal policy, economic stability, and the nation's financial health. It serves as a real-time tracker of the U.S. government's total public debt, providing transparency and insight into the nation's financial obligations. Understanding the debt clock is crucial for anyone interested in economics, public finance, or the long-term implications of government spending.

As the U.S. economy continues to evolve, the national debt clock plays a pivotal role in shaping public opinion and influencing policy decisions. This article delves into the intricacies of the United States National Debt Clock, exploring its significance, impact, and the broader economic context. Whether you're a student, policymaker, or simply someone curious about the nation's finances, this guide will provide valuable insights.

Our aim is to simplify complex economic concepts while ensuring the content is SEO-friendly and adheres to the highest standards of E-E-A-T (Expertise, Authoritativeness, Trustworthiness). Let's dive into the world of national debt and uncover its implications for the United States and the global economy.

Read also:What Happened To Joaquin Phoenixs Lip Unveiling The Truth Behind The Iconic Actors Transformation

Table of Contents

- What is the United States National Debt Clock?

- History of the United States National Debt Clock

- How the United States National Debt Clock Works

- Significance of the United States National Debt Clock

- Current State of the U.S. National Debt

- Factors Affecting the United States National Debt

- Economic Impact of the United States National Debt

- Government Policies and the National Debt

- International Perspective on U.S. National Debt

- Ways to Address the United States National Debt

What is the United States National Debt Clock?

The United States National Debt Clock is a digital display that tracks the total public debt of the U.S. government in real time. This clock provides a visual representation of the nation's financial obligations, updating continuously to reflect changes in the debt. It serves as a reminder of the fiscal challenges faced by the government and the importance of responsible financial management.

While the concept of a debt clock may seem straightforward, its implications are far-reaching. The clock not only highlights the magnitude of the debt but also raises awareness about the need for sustainable fiscal policies. By understanding the debt clock, citizens and policymakers can make informed decisions about the nation's financial future.

Understanding the Debt Clock's Purpose

The primary purpose of the United States National Debt Clock is to provide transparency and accountability in government spending. It acts as a tool for monitoring the growth of the national debt and serves as a call to action for addressing fiscal imbalances.

- It tracks both the total public debt and the debt per citizen.

- It highlights the interest payments on the debt.

- It provides a real-time snapshot of the nation's financial health.

History of the United States National Debt Clock

The concept of a national debt clock dates back to the late 20th century. The first debt clock was installed in New York City in 1989 by Seymour Durst, a real estate developer concerned about the growing national debt. Since then, the clock has become a symbol of fiscal responsibility and a tool for public awareness.

Over the years, the debt clock has evolved to include digital displays and online platforms, making it accessible to a global audience. Its history reflects the changing attitudes toward government debt and the increasing importance of fiscal transparency.

Key Milestones in the Debt Clock's History

Several milestones mark the development of the United States National Debt Clock:

Read also:Jayne Mansfield Car Accident The Tragic Event That Shocked Hollywood

- 1989: The first debt clock is installed in New York City.

- 2008: The clock resets due to the financial crisis and the rapid increase in national debt.

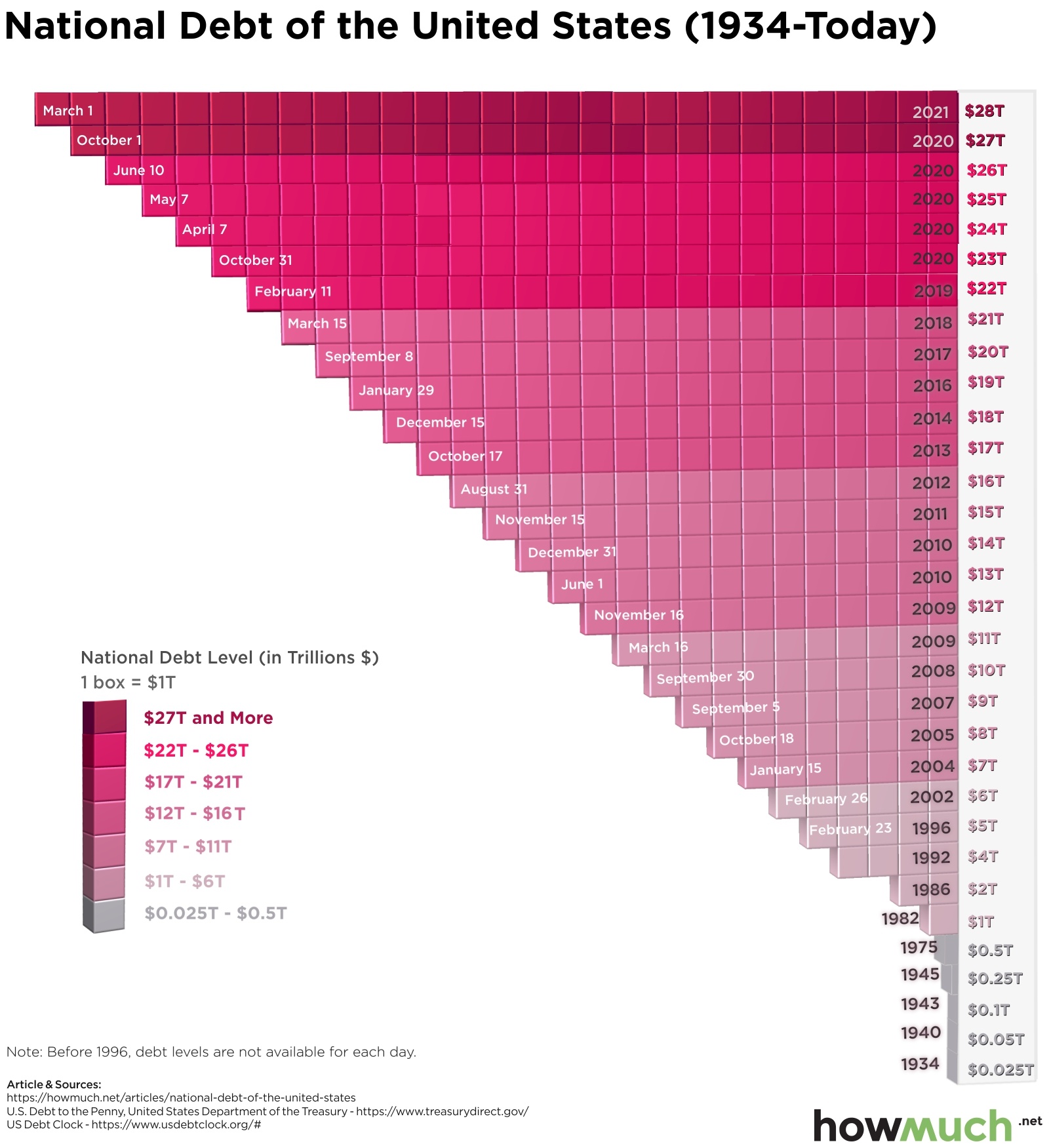

- 2020: The clock surpasses $27 trillion amid economic challenges caused by the pandemic.

How the United States National Debt Clock Works

The United States National Debt Clock operates by continuously updating data from official government sources. It tracks the total public debt, which includes both intragovernmental holdings and debt held by the public. The clock uses algorithms to calculate real-time changes in the debt, ensuring accuracy and reliability.

Data Sources for the Debt Clock

The debt clock relies on data from:

- The U.S. Treasury Department

- The Bureau of Economic Analysis

- The Federal Reserve

These sources provide the most up-to-date information on government spending, revenue, and debt levels, ensuring the clock remains a trusted source of financial data.

Significance of the United States National Debt Clock

The United States National Debt Clock holds significant importance for several reasons:

- It raises awareness about the nation's financial obligations.

- It serves as a tool for policymakers to monitor fiscal health.

- It influences public opinion and shapes discussions about economic policy.

By highlighting the growing national debt, the clock underscores the need for responsible fiscal management and sustainable economic practices.

Impact on Public Perception

The debt clock plays a crucial role in shaping public perception of the nation's financial health. It serves as a reminder of the consequences of excessive government spending and the importance of fiscal discipline. This awareness can lead to increased public engagement in economic issues and greater accountability from elected officials.

Current State of the U.S. National Debt

As of 2023, the United States national debt exceeds $31 trillion. This figure represents a significant increase from previous decades, driven by factors such as government spending, tax policies, and economic challenges. Understanding the current state of the debt is essential for assessing its long-term implications.

Key Statistics

Some key statistics about the U.S. national debt include:

- Total public debt: Over $31 trillion

- Debt per citizen: Approximately $93,000

- Interest payments on the debt: Hundreds of billions annually

These figures highlight the magnitude of the debt and the challenges it poses for future generations.

Factors Affecting the United States National Debt

Several factors contribute to the growth of the United States national debt:

- Government spending on social programs, defense, and infrastructure.

- Tax policies and revenue generation.

- Economic conditions, such as recessions and pandemics.

- Interest rates and borrowing costs.

Addressing these factors requires a comprehensive approach that balances economic growth with fiscal responsibility.

Role of Fiscal Policy

Fiscal policy plays a critical role in managing the national debt. By adjusting government spending and taxation, policymakers can influence the trajectory of the debt. However, finding the right balance between economic growth and fiscal sustainability remains a complex challenge.

Economic Impact of the United States National Debt

The United States national debt has far-reaching economic implications:

- It affects interest rates and borrowing costs for consumers and businesses.

- It influences investor confidence and the stability of financial markets.

- It impacts the nation's credit rating and international standing.

Understanding these impacts is essential for developing effective strategies to manage the debt and promote economic stability.

Long-Term Consequences

The long-term consequences of the national debt include potential reductions in government services, higher taxes, and decreased economic growth. Addressing these challenges requires proactive measures and a commitment to fiscal responsibility.

Government Policies and the National Debt

Government policies play a crucial role in managing the United States national debt. Through budgetary decisions, tax reforms, and economic policies, policymakers can influence the trajectory of the debt. Successful strategies often involve a combination of spending cuts, revenue enhancements, and economic growth initiatives.

Examples of Effective Policies

Some examples of effective policies include:

- Budgetary reforms that prioritize essential programs.

- Tax incentives to stimulate economic growth.

- Investments in infrastructure and education to boost productivity.

By implementing these policies, the government can work toward reducing the debt and promoting long-term economic stability.

International Perspective on U.S. National Debt

The United States national debt has significant implications for the global economy. As the world's largest economy, the U.S. debt affects international trade, currency markets, and global financial stability. Understanding the international perspective is essential for addressing the debt and promoting economic cooperation.

Global Impact

The global impact of the U.S. national debt includes:

- Influence on foreign exchange rates and currency markets.

- Effects on global trade and investment flows.

- Impact on international relations and geopolitical stability.

By addressing the debt, the U.S. can enhance its global standing and contribute to a more stable international economic environment.

Ways to Address the United States National Debt

Addressing the United States national debt requires a multifaceted approach that combines fiscal responsibility with economic growth. Some strategies include:

- Implementing budgetary reforms to reduce spending.

- Promoting tax policies that encourage revenue generation.

- Investing in education, infrastructure, and innovation to boost productivity.

By adopting these strategies, the U.S. can work toward reducing the debt and ensuring a sustainable economic future.

Call to Action

Reducing the national debt requires collective effort from policymakers, citizens, and businesses. We invite you to engage in discussions about fiscal responsibility, share this article with others, and explore additional resources on the topic. Together, we can contribute to a more financially stable future for the United States and the global economy.

Conclusion

The United States National Debt Clock serves as a powerful reminder of the nation's financial obligations and the importance of fiscal responsibility. By understanding its history, significance, and economic implications, we can work toward addressing the debt and promoting economic stability. This article has explored the key aspects of the debt clock, providing valuable insights and actionable strategies for managing the nation's finances.

We encourage you to take action by sharing your thoughts in the comments section, exploring related articles, and staying informed about economic issues. Together, we can make a difference in shaping the financial future of the United States and the world.