When it comes to choosing the right auto insurance plan, State Farm auto insurance plans stand out as one of the most reliable and comprehensive options available in the market today. As a leading insurance provider, State Farm has earned a reputation for delivering exceptional service and tailored coverage options that meet the diverse needs of its customers. Whether you're a first-time driver or a seasoned motorist, understanding the nuances of State Farm's offerings can help you make an informed decision about your coverage.

Auto insurance is not just a legal requirement; it's a vital investment in your financial security and peace of mind. With State Farm auto insurance plans, you gain access to a wide array of coverage options designed to protect you, your vehicle, and your passengers from unexpected events. From basic liability coverage to advanced protections like roadside assistance and rental reimbursement, State Farm ensures that every driver can find a plan that fits their lifestyle and budget.

In this article, we will explore the various features, benefits, and considerations associated with State Farm auto insurance plans. By the end of this guide, you will have a clear understanding of what sets State Farm apart from its competitors and why it might be the right choice for your insurance needs. Let's dive in!

Read also:Newark Terminal A Long Term Parking The Ultimate Guide For Travelers

Table of Contents

- Introduction to State Farm Auto Insurance Plans

- Coverage Options and Benefits

- About State Farm: A Trusted Name in Insurance

- Key Features of State Farm Auto Insurance

- Available Discounts and Savings

- Exceptional Customer Service

- Streamlined Claims Process

- Cost Analysis and Value for Money

- Comparison with Other Providers

- Frequently Asked Questions

- Conclusion and Final Thoughts

Introduction to State Farm Auto Insurance Plans

State Farm is one of the largest insurance providers in the United States, offering a wide range of products, including auto insurance plans. With a network of over 19,000 agents and representatives, State Farm serves millions of customers across the country. Their auto insurance plans are designed to provide comprehensive coverage while remaining flexible enough to accommodate individual needs.

Why Choose State Farm?

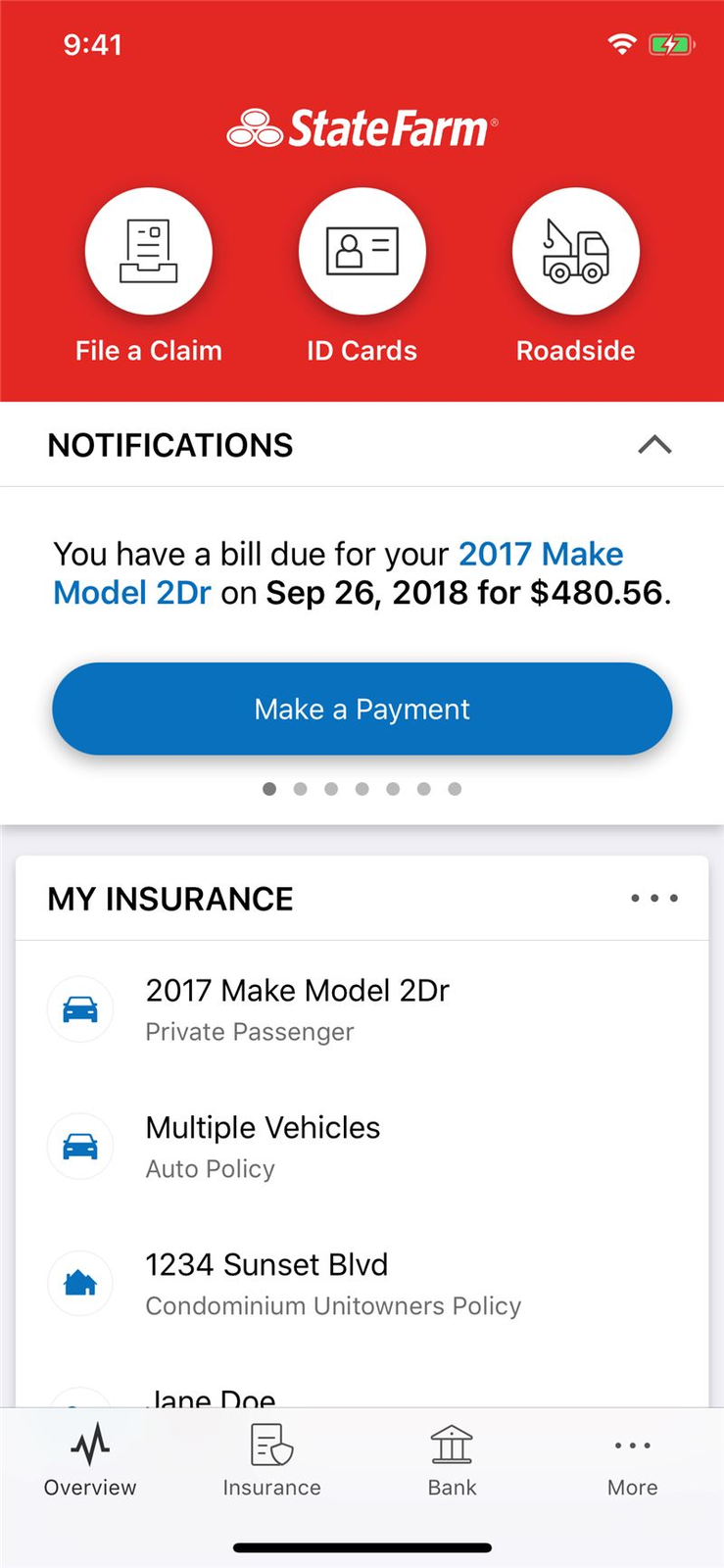

State Farm has consistently ranked high in customer satisfaction surveys due to its commitment to quality service and transparency. The company invests heavily in technology to enhance the user experience, making it easier for customers to manage their policies online or through mobile apps. Additionally, State Farm's financial stability ensures that policyholders receive the support they need when it matters most.

Coverage Options and Benefits

State Farm offers a variety of coverage options to suit different driving scenarios and lifestyles. Below are some of the key coverage types included in their auto insurance plans:

Liability Coverage

This mandatory coverage protects you from legal expenses if you're found at fault in an accident that causes bodily injury or property damage to others. State Farm provides both bodily injury liability and property damage liability coverage as part of its standard plans.

Collision Coverage

Collision coverage helps pay for repairs or replacement of your vehicle if it's damaged in a collision with another car or object. This coverage is particularly important for newer vehicles or those with higher value.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against non-collision incidents such as theft, vandalism, fire, or natural disasters. It's often paired with collision coverage to provide all-around protection for your vehicle.

Read also:Famous People With Als Inspiring Stories And Their Legacy

About State Farm: A Trusted Name in Insurance

Founded in 1922, State Farm Mutual Automobile Insurance Company began as a small operation focused on providing affordable auto insurance to farmers. Over the decades, the company has grown into a global leader in the insurance industry, offering a wide range of products and services.

State Farm Overview

| Founded | 1922 |

|---|---|

| Headquarters | Bloomington, Illinois |

| Revenue (2022) | $45.4 billion |

| Employees | 70,000+ |

Key Features of State Farm Auto Insurance

State Farm's auto insurance plans come with several standout features that set them apart from competitors. These include:

- 24/7 Roadside Assistance: Get help with flat tires, lockouts, or fuel delivery anytime, anywhere.

- Rental Reimbursement: Receive coverage for rental car expenses if your vehicle is being repaired after an accident.

- Gap Insurance: Protect yourself from financial loss if your vehicle is totaled and its value is less than what you owe on your loan.

Available Discounts and Savings

State Farm offers numerous discounts to help policyholders save money on their auto insurance premiums. Some of these include:

Safe Driver Discount

Drivers with a clean driving record can qualify for significant discounts on their premiums. State Farm rewards safe driving behavior by offering lower rates to those who avoid accidents and traffic violations.

Multi-Policy Discount

By bundling your auto insurance with other State Farm products, such as homeowners or life insurance, you can enjoy substantial savings on all your policies.

Exceptional Customer Service

State Farm prides itself on delivering exceptional customer service. Their team of agents and representatives is available to assist you with policy inquiries, claims, and other insurance-related matters. Whether you prefer in-person consultations, phone support, or digital communication, State Farm ensures that you receive the help you need promptly and efficiently.

Streamlined Claims Process

Filing a claim with State Farm is a straightforward process. The company offers multiple channels for submitting claims, including online portals, mobile apps, and phone support. Once your claim is submitted, State Farm's claims team will work quickly to assess the situation and provide a resolution.

Cost Analysis and Value for Money

While the cost of State Farm auto insurance plans can vary based on factors such as location, driving history, and coverage options, many customers find them to be competitively priced. By taking advantage of available discounts and tailoring your policy to your specific needs, you can achieve excellent value for money.

Comparison with Other Providers

When comparing State Farm to other insurance providers, it's important to consider factors such as coverage options, customer service, and pricing. State Farm consistently ranks highly in these areas, making it a top choice for many drivers. However, it's always a good idea to shop around and compare quotes to ensure you're getting the best deal.

Frequently Asked Questions

Q: How do I get a quote for State Farm auto insurance?

You can obtain a quote by visiting State Farm's website, contacting a local agent, or using their mobile app. The process is quick and easy, and you'll receive a personalized quote based on your driving history and coverage preferences.

Q: What factors affect my premium?

Several factors can influence your premium, including your age, driving record, vehicle type, location, and chosen coverage options. Maintaining a safe driving record and opting for higher deductibles can help lower your costs.

Conclusion and Final Thoughts

In conclusion, State Farm auto insurance plans offer a comprehensive suite of coverage options designed to meet the diverse needs of drivers across the United States. With a strong emphasis on customer service, competitive pricing, and innovative technology, State Farm continues to be a leader in the insurance industry.

We encourage you to take action by exploring State Farm's offerings and comparing them to other providers. Don't forget to leave a comment below sharing your thoughts or experiences with State Farm. Additionally, feel free to explore other articles on our site for more valuable insights into insurance and personal finance.

Remember, choosing the right auto insurance plan is an important decision that can impact your financial security and peace of mind. Trust State Farm to guide you through the process and provide the protection you deserve.

Data Source: State Farm Official Website