Understanding the difference between ABA and routing numbers is crucial for anyone involved in banking transactions. These terms are often used interchangeably, but their meanings and applications can vary slightly. This article will delve into the details, ensuring you have a clear understanding of their functions and relevance in today's financial landscape.

Banking terminology can be confusing, especially when terms like ABA and routing numbers are thrown around. It's essential to know what these terms mean and how they affect your banking activities. This guide aims to demystify these concepts and provide clarity on their usage.

Whether you're making a domestic transfer or setting up direct deposits, understanding the role of ABA and routing numbers can prevent costly errors. Let's explore these terms in detail and uncover the nuances that set them apart or make them similar.

Read also:What Time Do The Phillies Play On Thursday Your Ultimate Guide To Catching The Game

What is an ABA Number?

An ABA number, or American Bankers Association number, is a nine-digit code assigned to financial institutions in the United States. It was first introduced in 1910 by the American Bankers Association to facilitate the accurate and efficient processing of paper checks. Today, its use has expanded to include electronic transfers and other financial transactions.

Key Features of ABA Numbers

- Consists of nine digits

- Used primarily for check processing

- Identifies the specific bank or financial institution

- Facilitates the routing of financial transactions

ABA numbers are crucial for ensuring that funds are directed to the correct financial institution. Without this code, transactions could be delayed or sent to the wrong place, leading to potential financial losses.

What is a Routing Number?

A routing number is essentially the same as an ABA number. It is a nine-digit code used to identify banks and financial institutions in the United States. The term "routing number" is more commonly used today, especially in electronic transactions, but it refers to the same concept as the ABA number.

Types of Routing Numbers

- Wire transfer routing numbers

- ACH routing numbers

- Check processing routing numbers

While all routing numbers serve the same basic function, some banks may have different routing numbers for different types of transactions. For example, a bank might use one routing number for wire transfers and another for ACH transactions.

Is ABA the Same as Routing Number?

Yes, ABA and routing numbers are the same. The terms are used interchangeably in most contexts. Both refer to the nine-digit code that identifies a specific financial institution and ensures that funds are routed correctly during transactions.

Why the Different Terminology?

The difference in terminology often stems from historical usage and the context in which the term is used. "ABA number" is more commonly used in older banking systems and check processing, while "routing number" is the preferred term in modern electronic transactions.

Read also:Jw Marriott Guanacaste Resort Amp Spa A Paradise Retreat In Costa Rica

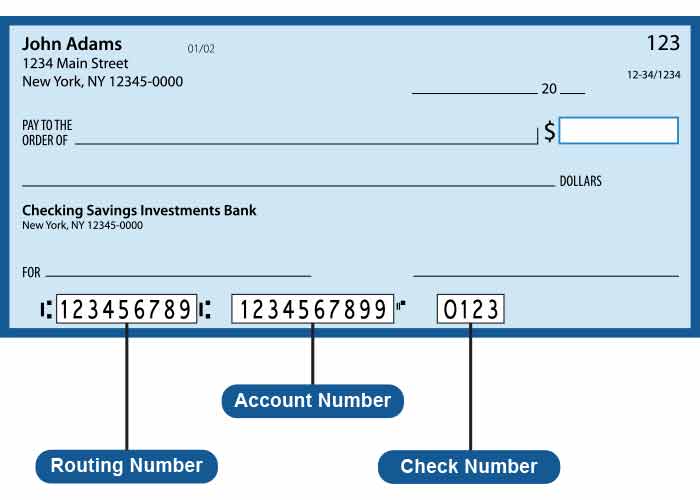

How to Find Your ABA/Routing Number

Finding your ABA/routing number is relatively simple. It can be found in several places:

- On the bottom left corner of your checks

- In your online banking account

- On your bank's website

- By contacting your bank's customer service

For those who don't have checks, accessing the number through online banking or contacting the bank directly is the most convenient option.

Importance of ABA/Routing Numbers in Transactions

ABA/routing numbers play a critical role in banking transactions. They ensure that funds are directed to the correct financial institution, preventing errors and delays. Whether you're setting up direct deposits, paying bills online, or transferring money between accounts, having the correct ABA/routing number is essential.

Common Uses of ABA/Routing Numbers

- Direct deposits

- Bill payments

- Wire transfers

- ACH transfers

Each of these transactions relies on the accuracy of the ABA/routing number to ensure that funds are processed correctly and efficiently.

ABA/Routing Numbers and Security

While ABA/routing numbers are essential for transactions, they are not sensitive personal information like account numbers or Social Security numbers. However, it's still important to keep them secure to prevent unauthorized transactions.

Best Practices for Securing ABA/Routing Numbers

- Do not share your routing number unnecessarily

- Use secure methods for transmitting financial information

- Monitor your accounts regularly for unauthorized activity

By following these best practices, you can help protect your financial information and prevent fraud.

ABA/Routing Numbers and International Transactions

ABA/routing numbers are specific to the United States and are not used in international transactions. For cross-border transfers, other codes such as SWIFT codes or IBANs are used. It's important to understand the difference between these systems to ensure that international transactions are processed correctly.

Comparison of ABA/Routing Numbers and SWIFT Codes

While both ABA/routing numbers and SWIFT codes serve the purpose of identifying financial institutions, they are used in different contexts:

- ABA/routing numbers: Domestic U.S. transactions

- SWIFT codes: International transactions

Knowing which code to use for a particular transaction can prevent delays and errors.

Common Questions About ABA/Routing Numbers

Can I Use My ABA/Routing Number for International Transactions?

No, ABA/routing numbers are only used for domestic transactions within the United States. For international transactions, you will need to use a SWIFT code or IBAN.

Do All Banks Have the Same Routing Number?

No, each bank has its own unique routing number. Additionally, some banks may have different routing numbers for different branches or types of transactions.

Can I Change My ABA/Routing Number?

In most cases, you cannot change your ABA/routing number. It is assigned by the bank and is specific to the institution. However, if the bank merges or changes its name, the routing number may change.

Conclusion

In summary, ABA and routing numbers are the same and play a vital role in ensuring the accuracy and efficiency of financial transactions. Understanding their functions and proper usage can help prevent errors and delays in your banking activities.

We encourage you to take the following actions:

- Verify your ABA/routing number before initiating any transaction

- Keep your financial information secure

- Explore related articles on our website for more insights into banking and finance

If you have any questions or comments, please feel free to leave them below. We value your feedback and are committed to providing accurate and helpful information.

Table of Contents

- What is an ABA Number?

- Key Features of ABA Numbers

- What is a Routing Number?

- Types of Routing Numbers

- Is ABA the Same as Routing Number?

- Why the Different Terminology?

- How to Find Your ABA/Routing Number

- Importance of ABA/Routing Numbers in Transactions

- Common Uses of ABA/Routing Numbers

- ABA/Routing Numbers and Security

- Best Practices for Securing ABA/Routing Numbers

- ABA/Routing Numbers and International Transactions

- Comparison of ABA/Routing Numbers and SWIFT Codes

- Common Questions About ABA/Routing Numbers

- Conclusion

Data and information for this article were sourced from reputable financial institutions and industry publications, ensuring the accuracy and reliability of the content.