What is an ABA number? It's a crucial nine-digit code used by banks in the United States to facilitate seamless financial transactions. This code is pivotal in ensuring that money moves correctly between institutions, whether you're setting up direct deposits or paying bills online. Understanding ABA numbers is essential for anyone managing finances in the U.S.

Imagine a world where bank transfers were riddled with errors, and payments took days or even weeks to process. The American Banking Association (ABA) recognized this potential issue and introduced the ABA routing number system to streamline banking operations. This system has been in place since 1910 and continues to be a cornerstone of modern banking infrastructure.

In this article, we'll explore what an ABA number is, its importance, and how to find and use it effectively. Whether you're a personal account holder or a business owner, having a clear understanding of ABA numbers can save you time, money, and frustration. Let's dive in!

Read also:Unveiling The Best Movie Theaters In Council Bluffs Your Ultimate Guide

Table of Contents

- What is an ABA Number?

- The History of ABA Numbers

- The Structure of an ABA Number

- How to Find Your ABA Number

- Common Uses of ABA Numbers

- ABA Number vs. SWIFT Code

- The Importance of ABA Numbers

- ABA Number Security Considerations

- Troubleshooting ABA Number Issues

- The Future of ABA Numbers

What is an ABA Number?

An ABA number, also known as a routing transit number (RTN), is a nine-digit code that identifies a financial institution in the United States. It serves as a unique identifier for banks and credit unions, ensuring that transactions are routed to the correct institution. This number is essential for domestic transfers, direct deposits, and various other financial activities.

Why is an ABA Number Important?

The primary function of an ABA number is to streamline the movement of money within the U.S. banking system. Without it, banks would struggle to verify the legitimacy of transactions, leading to delays and potential errors. Here are some reasons why ABA numbers are crucial:

- Facilitates accurate money transfers

- Ensures secure and efficient transactions

- Helps prevent fraud by verifying financial institutions

The History of ABA Numbers

The concept of ABA numbers dates back to 1910 when the American Banking Association introduced the routing transit number system. Initially, the system aimed to simplify check processing, which was a labor-intensive and error-prone task at the time. Over the years, the system evolved to accommodate electronic transactions, making it a cornerstone of modern banking.

Evolution of ABA Numbers

As technology advanced, the role of ABA numbers expanded beyond check processing. Today, they are integral to electronic fund transfers, direct deposits, and even mobile banking applications. The evolution of ABA numbers reflects the banking industry's commitment to innovation and efficiency.

The Structure of an ABA Number

An ABA number consists of nine digits, each with a specific purpose. Here's a breakdown of its structure:

- First four digits: Represent the Federal Reserve Routing Symbol

- Next four digits: Identify the financial institution

- Last digit: Acts as a checksum to validate the number

This structure ensures that every ABA number is unique and can be verified for accuracy.

Read also:Lexington Massachusetts 02421 Weather Your Ultimate Guide To Local Weather Patterns

How to Find Your ABA Number

Finding your ABA number is straightforward. Here are several methods you can use:

1. Check Your Paper Checks

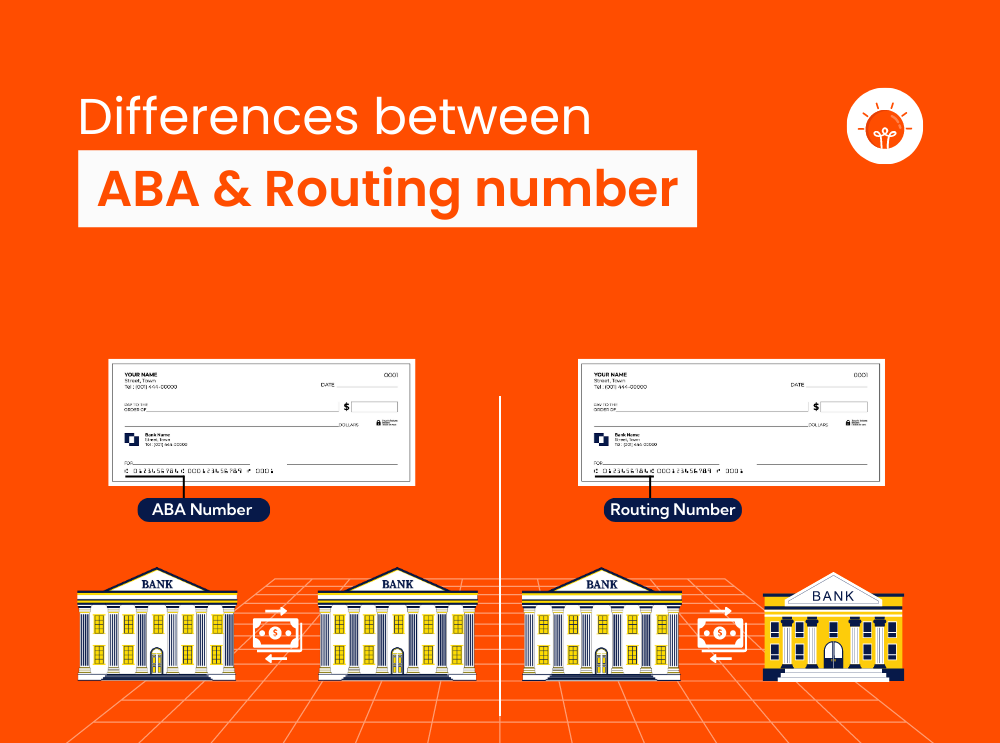

On the bottom left corner of your personal or business checks, you'll find a series of numbers. The first set of nine digits is your ABA number.

2. Online Banking

Most banks provide ABA numbers in the account information section of their online banking platforms. Simply log in to your account and look for the routing number.

3. Contact Your Bank

If you're unable to locate your ABA number, you can always contact your bank's customer service department for assistance.

Common Uses of ABA Numbers

ABA numbers are utilized in various financial transactions. Below are some of the most common uses:

- Direct deposits for salaries, pensions, and government benefits

- Bill payments through online banking platforms

- Wire transfers between domestic accounts

- Setting up recurring payments for subscriptions and services

Understanding these uses can help you manage your finances more effectively.

ABA Number vs. SWIFT Code

While ABA numbers are used for domestic transactions, SWIFT codes are employed for international transfers. Here's a comparison:

ABA Numbers

- Used within the United States

- Nine-digit code

- Facilitates domestic transfers

SWIFT Codes

- Used globally

- Eight to eleven alphanumeric characters

- Facilitates international transfers

Knowing the difference between these two systems is essential for individuals and businesses engaging in cross-border transactions.

The Importance of ABA Numbers

ABA numbers play a critical role in maintaining the integrity of the U.S. banking system. They ensure that transactions are executed accurately and efficiently, reducing the risk of errors and fraud. Furthermore, they provide a standardized method for financial institutions to communicate and process payments.

Impact on Financial Transactions

Without ABA numbers, the banking system would face significant challenges in verifying and processing transactions. This could lead to delays, increased costs, and potential disputes. By relying on ABA numbers, banks can maintain trust and transparency in their operations.

ABA Number Security Considerations

While ABA numbers are essential for financial transactions, they must be handled with care to prevent misuse. Here are some security tips:

- Never share your ABA number unnecessarily

- Use secure channels when transmitting sensitive financial information

- Monitor your accounts regularly for unauthorized transactions

By following these precautions, you can protect your financial information and minimize the risk of fraud.

Troubleshooting ABA Number Issues

If you encounter problems with your ABA number, here are some steps you can take:

Verify the Number

Double-check the ABA number to ensure it's correct. A single digit error can result in failed transactions.

Contact Your Bank

If the issue persists, contact your bank's customer service department for assistance. They can verify the number and help resolve any discrepancies.

Check Transaction Details

Review the details of the transaction to ensure all information is accurate. This includes account numbers, transaction amounts, and recipient details.

The Future of ABA Numbers

As technology continues to evolve, the role of ABA numbers may adapt to meet changing financial needs. While they remain a vital component of the U.S. banking system, advancements in digital banking and blockchain technology could influence their future use. Regardless of these changes, ABA numbers will likely continue to play a significant role in ensuring the accuracy and security of financial transactions.

Emerging Technologies

Innovations such as real-time payments and decentralized finance may impact how ABA numbers are used. However, their fundamental purpose—to identify financial institutions and facilitate transactions—will remain unchanged.

Conclusion

In conclusion, understanding what an ABA number is and how it functions is essential for anyone managing finances in the United States. From facilitating direct deposits to ensuring secure transactions, ABA numbers are a vital component of the banking system. By following the tips and guidelines outlined in this article, you can make the most of your ABA number and protect your financial information.

We encourage you to share this article with others who may benefit from learning about ABA numbers. Additionally, feel free to leave a comment below if you have any questions or need further clarification. Together, let's promote financial literacy and security for everyone!