Investing in healthcare stocks can be a lucrative opportunity for those looking to diversify their portfolios and capitalize on one of the world's most essential industries. Healthcare is a sector that continues to grow consistently, driven by factors such as an aging population, advancements in medical technology, and increasing healthcare spending globally. Whether you're a seasoned investor or just starting, understanding how to invest in healthcare stocks is crucial to making informed decisions.

The healthcare industry is vast and encompasses various sub-sectors, including pharmaceuticals, biotechnology, medical devices, and healthcare services. Each of these sub-sectors offers unique opportunities and challenges. In this article, we will explore the key aspects of investing in healthcare stocks, providing you with actionable insights and strategies to navigate this dynamic market.

Our goal is to equip you with the knowledge and tools necessary to evaluate healthcare stocks effectively. By the end of this guide, you'll have a clearer understanding of how to identify promising healthcare stocks, assess risks, and build a diversified portfolio that aligns with your investment goals.

Read also:Most Healthy Food At Wendys Your Ultimate Guide To Smart Dining

Why Invest in Healthcare Stocks?

The healthcare sector has consistently outperformed other industries over the years, making it an attractive option for investors. Below are some compelling reasons to consider investing in healthcare stocks:

- Steady Growth: The healthcare industry is less vulnerable to economic downturns compared to other sectors, as people always need medical services regardless of economic conditions.

- Innovative Developments: Breakthroughs in medical research and technology continue to drive growth in the healthcare sector, creating new opportunities for investors.

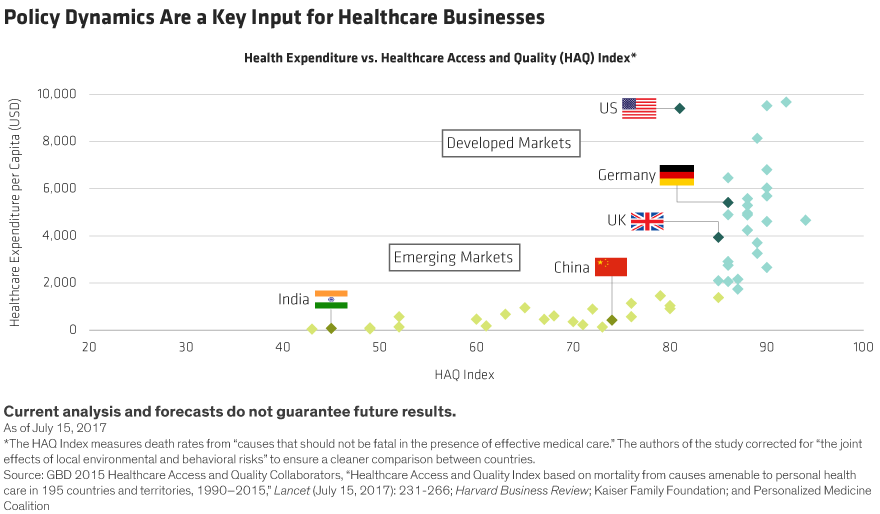

- Demographic Trends: An aging global population and rising healthcare costs contribute to the increasing demand for healthcare services and products.

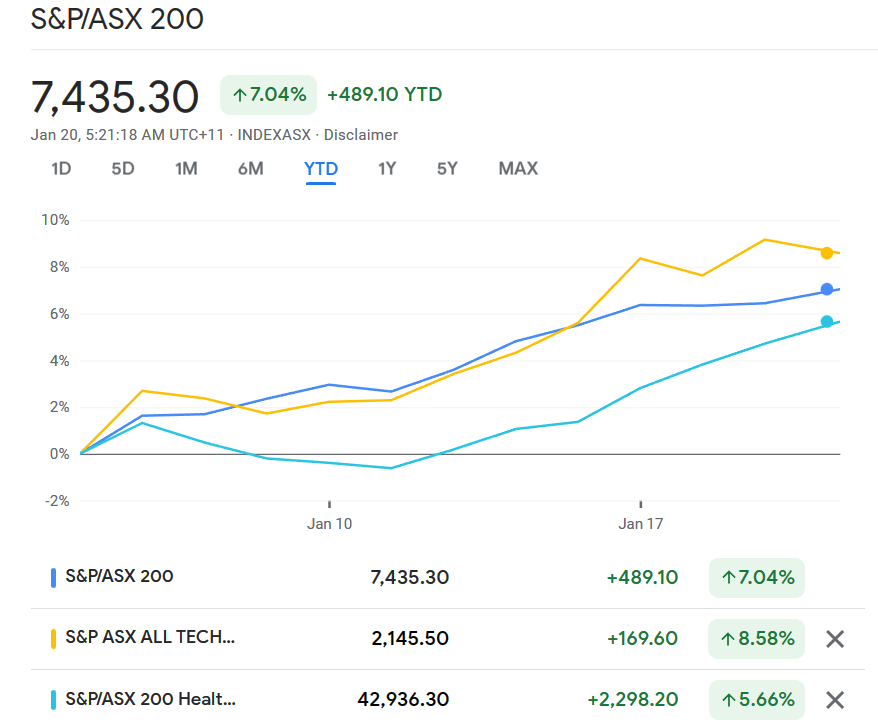

According to a report by Grand View Research, the global healthcare market is projected to grow at a CAGR of 10.8% from 2023 to 2030. These figures underscore the potential for significant returns in the healthcare stock market.

Understanding the Healthcare Sector

Before diving into healthcare stocks, it's essential to understand the various sub-sectors within the healthcare industry:

Pharmaceuticals

Pharmaceutical companies focus on the research, development, and production of prescription drugs. This sub-sector is driven by innovation and patent protection, which can lead to substantial profits.

Biotechnology

Biotech firms specialize in using biological processes to develop medical treatments and therapies. This segment is highly innovative but often carries higher risks due to the lengthy and expensive drug approval process.

Medical Devices

Companies in this sub-sector produce devices and equipment used in medical procedures. The demand for advanced medical devices is expected to rise as healthcare providers seek more efficient and effective tools.

Read also:Erie Insurance Rental Car Comprehensive Guide To Coverage Benefits And Faqs

Healthcare Services

This includes hospitals, clinics, and other healthcare providers that deliver medical services directly to patients. The healthcare services sub-sector benefits from the increasing demand for healthcare due to population growth and aging.

How to Start Investing in Healthcare Stocks

Investing in healthcare stocks requires a strategic approach. Below are some steps to help you get started:

1. Research and Education

Before investing, educate yourself about the healthcare industry and its dynamics. Familiarize yourself with key terms, trends, and factors influencing the market.

2. Set Clear Investment Goals

Define your investment objectives, whether it's long-term wealth accumulation or short-term gains. This will guide your decision-making process when selecting healthcare stocks.

3. Choose the Right Stocks

Select healthcare stocks that align with your investment goals. Consider factors such as company size, financial health, and competitive position in the market.

4. Diversify Your Portfolio

Spread your investments across different sub-sectors within the healthcare industry to mitigate risks. Diversification helps protect your portfolio from sector-specific downturns.

Evaluating Healthcare Stocks

When evaluating healthcare stocks, consider the following factors:

Financial Performance

Examine the company's financial statements to assess its profitability, revenue growth, and cash flow. Strong financial health is a key indicator of a company's ability to sustain and grow its operations.

Management Quality

Investigate the leadership team's experience and track record. A competent management team is crucial for driving innovation and navigating challenges in the healthcare industry.

Product Pipeline

For pharmaceutical and biotech companies, the product pipeline is a critical factor. A robust pipeline with promising drug candidates can significantly impact a company's future growth potential.

Top Healthcare Stocks to Consider

Here are some of the leading healthcare stocks worth considering:

Johnson & Johnson (JNJ)

Johnson & Johnson is a diversified healthcare company with operations in pharmaceuticals, medical devices, and consumer health products. Its strong brand presence and consistent dividend payments make it an attractive option for long-term investors.

Pfizer Inc. (PFE)

Pfizer is a global pharmaceutical giant known for its innovative drug development. The company's recent success with the COVID-19 vaccine highlights its ability to adapt to emerging healthcare needs.

Medtronic plc (MDT)

Medtronic is a leading medical device manufacturer, offering a wide range of products for various medical procedures. Its focus on innovation and global expansion contributes to its competitive advantage.

Risks Associated with Healthcare Stocks

While healthcare stocks offer significant growth potential, they also come with certain risks:

Regulatory Challenges

The healthcare industry is heavily regulated, and changes in government policies or regulations can impact companies' operations and profitability.

Research and Development Costs

Developing new drugs and medical technologies is expensive and time-consuming. Companies that fail to bring successful products to market may struggle financially.

Market Competition

The healthcare sector is highly competitive, with numerous players vying for market share. Companies must continuously innovate to maintain their competitive edge.

Strategies for Successful Healthcare Stock Investing

Implementing the right strategies can enhance your chances of success when investing in healthcare stocks:

1. Stay Informed

Keep up with industry news, trends, and developments. Subscribe to reputable financial publications and follow leading healthcare analysts to gain insights into market movements.

2. Monitor Economic Indicators

Pay attention to economic indicators that may affect the healthcare industry, such as interest rates, inflation, and healthcare spending trends.

3. Reassess Regularly

Periodically review your portfolio to ensure it aligns with your investment goals and risk tolerance. Adjust your holdings as needed to maintain a balanced and diversified portfolio.

How to Invest in Healthcare Stocks Through ETFs

Exchange-Traded Funds (ETFs) offer a convenient way to invest in healthcare stocks without selecting individual companies:

Healthcare Select Sector SPDR Fund (XLV)

XLV tracks the performance of healthcare companies within the S&P 500 Index, providing broad exposure to the sector.

Vanguard Healthcare ETF (VHT)

VHT invests in a diverse range of healthcare stocks, offering a cost-effective way to access the industry's growth potential.

Conclusion

Investing in healthcare stocks can be a rewarding endeavor for those willing to invest time in research and analysis. By understanding the industry's dynamics, evaluating key factors, and implementing sound investment strategies, you can position yourself for success in this thriving market.

We encourage you to share your thoughts and experiences in the comments section below. Additionally, explore other articles on our website for more insights into the world of investing. Together, let's build a smarter and more informed approach to growing your wealth.

Table of Contents

- Why Invest in Healthcare Stocks?

- Understanding the Healthcare Sector

- How to Start Investing in Healthcare Stocks

- Evaluating Healthcare Stocks

- Top Healthcare Stocks to Consider

- Risks Associated with Healthcare Stocks

- Strategies for Successful Healthcare Stock Investing

- How to Invest in Healthcare Stocks Through ETFs