Ordering Chase personal checks is a crucial task for managing your finances effectively. Whether you're setting up a new account or need to replace your old checks, understanding the process can save you time and hassle. In this article, we will delve into everything you need to know about Chase personal checks, including how to order them, what to expect, and tips for maintaining your financial health.

Chase personal checks serve as one of the most reliable methods for making payments, especially in situations where cash or digital transactions aren't feasible. They provide a secure and traceable way to transfer funds, making them indispensable for many individuals. However, ordering these checks can sometimes feel daunting, especially if you're unfamiliar with the process.

This guide aims to simplify the process by breaking it down step-by-step, offering valuable insights, and addressing common concerns. Whether you're a new Chase customer or a seasoned one, this article will ensure you have all the information you need to order your checks confidently.

Read also:How Many Children Does Shaquille Oneal Have A Comprehensive Look Into His Family Life

Table of Contents

- Biography of Chase

- Understanding the Chase Personal Checks Ordering Process

- How to Order Chase Personal Checks Online

- Ordering Checks at a Chase Branch

- Customizing Your Chase Personal Checks

- Delivery Options for Chase Personal Checks

- Security Features of Chase Personal Checks

- Cost of Chase Personal Checks

- Troubleshooting Common Issues

- Tips for Managing Chase Personal Checks

A Brief History of Chase Bank

Founding and Growth

Chase Bank, officially known as JPMorgan Chase & Co., was founded in 1799 as The Bank of the Manhattan Company. Over the years, it has grown into one of the largest financial institutions in the United States. Its commitment to innovation and customer service has made it a trusted name in banking.

Financial Services

Chase offers a wide range of financial services, including personal banking, business banking, wealth management, and investment services. Their personal banking products, such as checking accounts and personal checks, are designed to meet the diverse needs of their customers.

| Company Name | JPMorgan Chase & Co. |

|---|---|

| Founded | 1799 |

| Headquarters | New York City, USA |

| CEO | Jamie Dimon |

Understanding the Chase Personal Checks Ordering Process

Ordering Chase personal checks involves a straightforward process that can be completed either online or in person at a Chase branch. Understanding the steps involved can help you prepare and ensure a smooth experience.

Steps to Order Chase Personal Checks

Here are the key steps you should follow:

- Access your Chase account online or visit a local branch.

- Select the option to order checks.

- Choose the type and quantity of checks you need.

- Customize your checks with your personal details.

- Confirm your order and select a delivery method.

How to Order Chase Personal Checks Online

Ordering Chase personal checks online is convenient and efficient. It allows you to place your order anytime, from anywhere, as long as you have internet access.

Step-by-Step Guide

- Log in to Your Account: Go to the Chase website and log in using your credentials.

- Locate the Checks Option: Navigate to the section where you can order checks.

- Select Your Preferences: Choose the type of checks you want, including the number of books or single checks.

- Customize Your Checks: Add your personal information, such as your name, address, and any additional details you prefer.

- Review and Confirm: Double-check all the details and confirm your order.

Ordering Checks at a Chase Branch

If you prefer a face-to-face interaction, visiting a Chase branch is a great option. It allows you to ask questions and receive immediate assistance if needed.

Read also:Chase Bank Computers Down A Comprehensive Analysis Of The Incident

What to Bring

Make sure to bring the following items when visiting a Chase branch:

- Government-issued ID

- Your Chase account information

- Any specific preferences for your checks

Customizing Your Chase Personal Checks

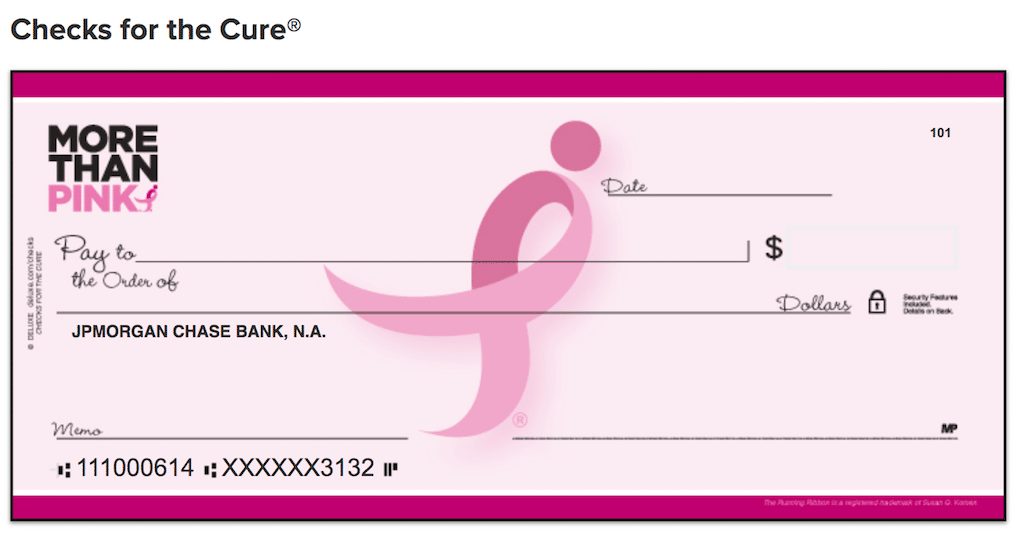

Chase offers several customization options to make your checks unique and personalized. You can add your name, address, phone number, and even a custom design or logo if desired.

Popular Customization Options

- Choice of check color and style

- Option to include a signature line

- Ability to add a return address

Delivery Options for Chase Personal Checks

Once you've placed your order, you can choose from various delivery options. Chase offers both standard and expedited shipping, depending on your needs.

Standard Delivery

Standard delivery typically takes 7-10 business days and is free of charge for most customers.

Expedited Delivery

For those in need of their checks sooner, expedited delivery is available for an additional fee. This option usually delivers within 3-5 business days.

Security Features of Chase Personal Checks

Chase personal checks come equipped with advanced security features to protect against fraud and unauthorized use. These features include watermarks, security threads, and specialized inks.

Key Security Features

- Watermark embedded in the paper

- Security thread visible under UV light

- Specialized ink that changes color when exposed to heat

Cost of Chase Personal Checks

The cost of Chase personal checks varies depending on the type and quantity ordered. Most customers can expect to pay between $15 and $30 per order, with additional fees for expedited shipping if chosen.

Pricing Breakdown

- Basic checks: $15-$20

- Premium checks: $25-$30

- Expedited shipping: $10-$20

Troubleshooting Common Issues

Occasionally, customers may encounter issues when ordering Chase personal checks. Below are some common problems and their solutions:

Problem: Delayed Delivery

Solution: Contact Chase customer service to check the status of your order. They can provide updates and assist with any delays.

Problem: Incorrect Information on Checks

Solution: If you notice any errors on your checks, contact Chase immediately to request a replacement order at no additional cost.

Tips for Managing Chase Personal Checks

To make the most of your Chase personal checks, consider the following tips:

Best Practices

- Always keep your checks in a secure location.

- Reconcile your checkbook regularly to avoid overdrafts.

- Notify Chase immediately if you lose your checks or suspect fraud.

Conclusion

Ordering Chase personal checks is a simple and efficient process, whether you choose to do it online or in person at a Chase branch. By understanding the steps involved, customizing your checks to suit your needs, and being aware of the security features and costs, you can ensure a hassle-free experience.

We encourage you to take action by ordering your Chase personal checks today. If you have any questions or feedback, feel free to leave a comment below. Additionally, don't forget to share this article with others who might find it helpful. For more informative content, explore our other articles on personal finance and banking solutions.

Data and statistics provided in this article are sourced from Chase official resources and industry reports, ensuring accuracy and reliability. Remember, managing your finances wisely is key to achieving long-term financial stability.

![How To Order Checks From Chase Phone, Prices) [2018]](https://i0.wp.com/uponarriving.com/wp-content/uploads/2022/09/Order-Chase-Checks-Online2.png)