ABA routing numbers play a crucial role in the banking system, ensuring that financial transactions are processed accurately and efficiently. Whether you're transferring funds domestically or internationally, these nine-digit codes help banks identify each other and streamline the movement of money. Understanding ABA routing numbers can help you avoid mistakes and ensure your financial transactions run smoothly.

For anyone who frequently deals with banking transactions, it's essential to understand what ABA routing numbers are and how they function. These numbers serve as unique identifiers for banks, facilitating seamless communication between financial institutions. This article aims to provide a thorough understanding of ABA routing numbers, their purpose, and how they impact your banking activities.

Whether you're setting up direct deposits, paying bills online, or transferring money to another account, knowing your ABA routing number is vital. This guide will walk you through everything you need to know about ABA routing numbers, including how to locate them, their importance, and common misconceptions. Let's dive in!

Read also:Where Was Joe Biden Born A Comprehensive Exploration Of The 46th Us Presidents Origins

Table of Contents

- What is an ABA Routing Number?

- The History of ABA Routing Numbers

- The Structure of an ABA Routing Number

- How to Find Your ABA Routing Number

- Common Uses of ABA Routing Numbers

- ABA Routing Number vs. ACH Routing Number

- Why ABA Routing Numbers are Important

- Security Concerns with ABA Routing Numbers

- Common Issues with ABA Routing Numbers

- Tips for Managing ABA Routing Numbers

What is an ABA Routing Number?

An ABA routing number, also known as a routing transit number (RTN), is a nine-digit code used by banks and financial institutions in the United States to facilitate the transfer of funds between accounts. These numbers were first introduced by the American Bankers Association (ABA) in 1910 and have since become an integral part of the U.S. banking system.

The primary function of an ABA routing number is to identify the specific financial institution where an account is held. This ensures that funds are directed to the correct bank or credit union during transactions such as direct deposits, wire transfers, and automatic bill payments.

How Does an ABA Routing Number Work?

When you initiate a financial transaction, the ABA routing number is used to determine which bank or credit union is involved. For example, if you're setting up direct deposit for your paycheck, your employer will need both your account number and your bank's ABA routing number to ensure the funds are deposited into the correct account.

Here are some key points about how ABA routing numbers work:

- They are unique to each financial institution.

- They help streamline the processing of checks and electronic payments.

- They are essential for domestic transactions within the U.S.

The History of ABA Routing Numbers

The concept of routing numbers dates back to the early 20th century when the American Bankers Association introduced them in 1910. At the time, the banking industry needed a standardized system to facilitate the exchange of checks between banks. The ABA routing number system was created to address this need, providing a unique identifier for each financial institution.

Over the years, the system has evolved to accommodate advancements in technology and the increasing complexity of financial transactions. Today, ABA routing numbers are used not only for check processing but also for electronic funds transfers, direct deposits, and other types of financial transactions.

Read also:What Happened To Joaquin Phoenixs Lip Unveiling The Truth Behind The Iconic Actors Transformation

Evolution of ABA Routing Numbers

As the banking industry has grown and changed, so too has the ABA routing number system. Here are some key milestones in its evolution:

- 1910: The first ABA routing numbers are introduced.

- 1950s: The system is expanded to include more financial institutions.

- 1970s: The introduction of electronic banking increases the use of routing numbers.

- 2000s: Advances in technology lead to the widespread use of routing numbers in online banking.

The Structure of an ABA Routing Number

An ABA routing number consists of nine digits, each with a specific purpose. Understanding the structure of these numbers can help you better comprehend how they function and why they are so important.

The first four digits represent the Federal Reserve routing symbol, which identifies the Federal Reserve Bank that serves the financial institution. The next four digits are the ABA institution identifier, which uniquely identifies the bank or credit union. The final digit is a checksum, which is used to verify the accuracy of the routing number.

Breaking Down the Nine Digits

Here's a closer look at the components of an ABA routing number:

- Digits 1-4: Federal Reserve routing symbol

- Digits 5-8: ABA institution identifier

- Digit 9: Checksum

How to Find Your ABA Routing Number

Locating your ABA routing number is a straightforward process. There are several ways to find this information, depending on your preference and the tools available to you.

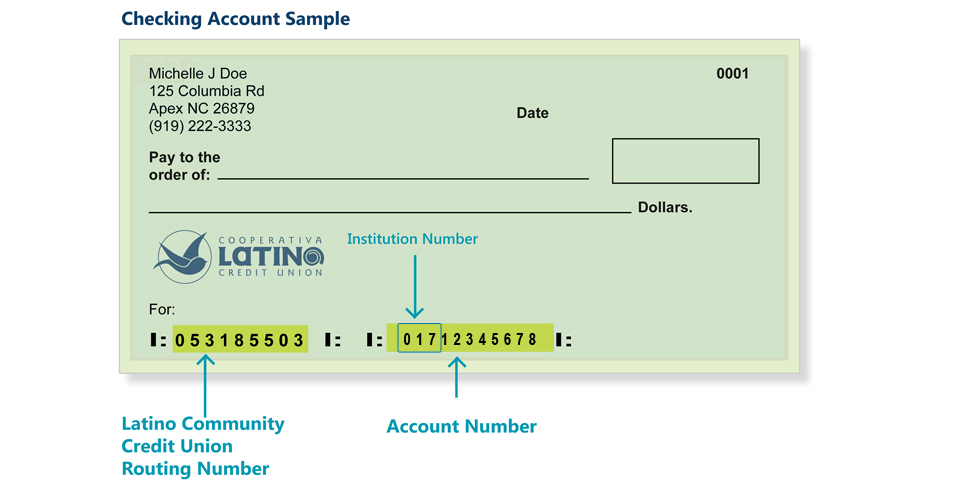

The most common method is to check your checks. Your ABA routing number is typically printed on the bottom left corner of your checks, followed by your account number and the check number. Alternatively, you can find your routing number by logging into your online banking account or contacting your bank's customer service department.

Alternative Methods for Finding Your Routing Number

In addition to checking your checks or online banking, here are some other ways to find your ABA routing number:

- Contact your bank's customer service department.

- Visit your bank's website and look for routing number information.

- Use a routing number lookup tool provided by your bank or a third-party service.

Common Uses of ABA Routing Numbers

ABA routing numbers are used in a variety of financial transactions, both online and offline. Some of the most common uses include:

Direct Deposits: When setting up direct deposit for your paycheck or government benefits, you'll need to provide your employer or the relevant agency with your ABA routing number and account number.

Bill Payments: Many banks and credit unions allow you to set up automatic bill payments using your ABA routing number and account information.

Wire Transfers: If you need to send or receive a wire transfer, you'll typically need to provide your bank's ABA routing number to ensure the funds are directed to the correct institution.

Other Uses of ABA Routing Numbers

Beyond the examples above, ABA routing numbers are also used for:

- Online banking transactions

- Mobile check deposits

- Peer-to-peer payments

ABA Routing Number vs. ACH Routing Number

While ABA routing numbers and ACH routing numbers are often used interchangeably, they serve slightly different purposes. An ABA routing number is used for domestic transactions within the U.S., while an ACH routing number is specifically used for electronic funds transfers through the Automated Clearing House (ACH) network.

In most cases, the ABA routing number and ACH routing number for a given bank or credit union will be the same. However, some institutions may use different numbers for ACH transactions, so it's important to verify which number to use based on the type of transaction you're initiating.

Key Differences Between ABA and ACH Routing Numbers

Here are some key differences between ABA and ACH routing numbers:

- ABA routing numbers are used for all types of transactions, while ACH routing numbers are used specifically for electronic transfers.

- Some banks may have different ABA and ACH routing numbers.

- ACH routing numbers are typically used for recurring payments, such as utility bills or subscription services.

Why ABA Routing Numbers are Important

ABA routing numbers are essential for ensuring the accuracy and efficiency of financial transactions. Without these numbers, banks and other financial institutions would struggle to process checks, electronic payments, and wire transfers in a timely and reliable manner.

By providing a unique identifier for each financial institution, ABA routing numbers help prevent errors and ensure that funds are directed to the correct account. This is particularly important in today's fast-paced digital world, where financial transactions are often completed in seconds.

The Role of ABA Routing Numbers in Modern Banking

In the modern banking landscape, ABA routing numbers play a critical role in facilitating the movement of money. They help ensure that:

- Checks are processed accurately and efficiently.

- Electronic payments are completed without delays.

- Wire transfers are directed to the correct institution.

Security Concerns with ABA Routing Numbers

While ABA routing numbers are essential for financial transactions, they can also pose security risks if they fall into the wrong hands. Fraudsters may use stolen routing numbers to initiate unauthorized transactions or gain access to sensitive financial information.

To protect yourself, it's important to keep your ABA routing number and account information confidential. Avoid sharing this information unnecessarily, and be cautious when providing it online or over the phone.

Best Practices for Protecting Your ABA Routing Number

Here are some tips for safeguarding your ABA routing number:

- Never share your routing number with untrusted parties.

- Use secure methods for transmitting sensitive financial information.

- Regularly monitor your bank statements for suspicious activity.

Common Issues with ABA Routing Numbers

Despite their importance, ABA routing numbers can sometimes cause problems for consumers. Common issues include:

Incorrect Routing Numbers: Providing the wrong routing number can result in delayed or failed transactions. Always double-check the routing number before initiating a transaction.

Outdated Information: If your bank merges with another institution or changes its name, your routing number may also change. Be sure to update your records accordingly.

How to Resolve Routing Number Issues

If you encounter problems with your ABA routing number, here's what you can do:

- Contact your bank's customer service department for assistance.

- Verify the correct routing number using your checks or online banking.

- Update your records with employers or other parties who rely on your routing number.

Tips for Managing ABA Routing Numbers

To make the most of your ABA routing number and avoid common pitfalls, consider the following tips:

Keep Your Information Up-to-Date: Regularly review your banking information to ensure it's accurate and up-to-date. This includes your routing number, account number, and any other relevant details.

Use Secure Methods for Sharing Information: When providing your routing number to third parties, use secure methods such as encrypted email or secure messaging systems.

Final Thoughts on ABA Routing Numbers

ABA routing numbers are a vital component of the U.S. banking system, ensuring that financial transactions are processed accurately and efficiently. By understanding how these numbers work and taking steps to protect them, you can help safeguard your financial information and avoid costly mistakes.

Conclusion

In conclusion, ABA routing numbers are essential for facilitating financial transactions and ensuring the smooth operation of the banking system. From direct deposits to wire transfers, these nine-digit codes play a critical role in the movement of money. By understanding their purpose, structure, and importance, you can better manage your finances and protect your sensitive information.

We encourage you to share this article with others who may benefit from learning about ABA routing numbers. If you have any questions or comments, feel free to leave them below. And don't forget to explore our other articles for more valuable insights into personal finance and banking!