Granite State Credit Union loan options offer a reliable and affordable way to meet your financial needs. Whether you're planning to buy a car, consolidate debt, or invest in a major purchase, this credit union provides a wide range of loan products tailored to fit your lifestyle. With competitive interest rates and flexible repayment terms, Granite State Credit Union stands out as a trusted financial partner for individuals and families in New Hampshire.

When it comes to securing a loan, choosing the right financial institution is crucial. Granite State Credit Union has been serving its members for decades, offering personalized service and competitive loan products. Their commitment to member satisfaction and financial well-being makes them an ideal choice for anyone seeking a loan.

This comprehensive guide will walk you through everything you need to know about Granite State Credit Union loans. From understanding the types of loans available to exploring eligibility requirements and application processes, we'll cover all the essential details to help you make an informed decision.

Read also:Uncle Fester Played By A Comprehensive Look At The Iconic Character And His Portrayers

Table of Contents

- About Granite State Credit Union

- Types of Loans Offered

- Eligibility Requirements

- Loan Application Process

- Interest Rates and Fees

- Benefits of Granite State Credit Union Loans

- Tips for Applying for a Loan

- Member Testimonials

- Frequently Asked Questions

- Conclusion

About Granite State Credit Union

Granite State Credit Union, established in 1969, is a member-owned financial cooperative serving the residents of New Hampshire. With a mission to empower members financially, the credit union offers a wide array of services, including savings accounts, checking accounts, credit cards, and loans. Their commitment to providing affordable financial solutions has earned them a reputation as a trusted financial institution in the region.

History and Mission

Granite State Credit Union was founded to serve the employees of the New Hampshire Department of Corrections. Over the years, it has expanded its field of membership to include individuals living or working in specific counties in New Hampshire. Their mission remains focused on delivering exceptional service, fostering financial literacy, and helping members achieve their financial goals.

Core Values

- Integrity: Upholding ethical standards in all transactions.

- Excellence: Providing high-quality service and innovative financial solutions.

- Community: Supporting local communities through partnerships and initiatives.

Types of Loans Offered

Granite State Credit Union offers a diverse range of loan products designed to meet various financial needs. These loans are structured to provide flexibility and affordability, ensuring members can access the funds they need without undue stress.

Personal Loans

Personal loans from Granite State Credit Union can be used for a variety of purposes, such as debt consolidation, home improvements, or unexpected expenses. These loans typically come with fixed interest rates and predictable repayment schedules.

Auto Loans

Whether you're buying a new or used vehicle, Granite State Credit Union provides competitive auto loan options. Their auto loans feature low interest rates and flexible terms, making it easier for members to finance their dream cars.

Mortgage Loans

For those looking to purchase a home, Granite State Credit Union offers mortgage loans with attractive interest rates and personalized service. They work closely with members to find the best mortgage solution for their needs.

Read also:Exploring The Iconic Actors In All In The Family

Eligibility Requirements

To qualify for a Granite State Credit Union loan, applicants must meet specific eligibility criteria. These requirements ensure that the credit union can offer loans responsibly and sustainably.

Membership Requirements

One of the primary eligibility criteria is membership in Granite State Credit Union. Membership is open to individuals who live, work, worship, or attend school in specific counties in New Hampshire. Additionally, immediate family members of existing members may also join.

Credit Score and Financial History

A strong credit score and a solid financial history can significantly improve your chances of loan approval. Granite State Credit Union reviews applicants' credit reports to assess their creditworthiness and determine appropriate loan terms.

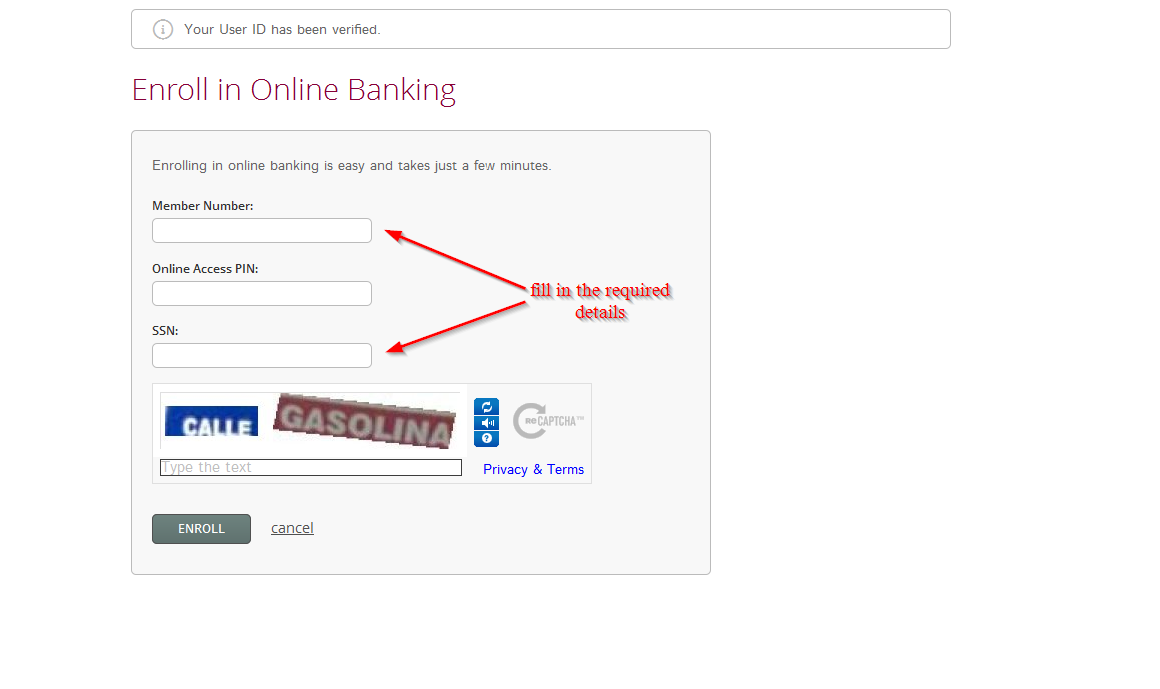

Loan Application Process

The loan application process at Granite State Credit Union is straightforward and designed to be member-friendly. Here's a step-by-step guide to help you navigate the process:

- Visit the Granite State Credit Union website or contact a local branch to request a loan application.

- Gather necessary documentation, including proof of income, identification, and financial statements.

- Submit your completed application and supporting documents to the credit union.

- A loan officer will review your application and may contact you for additional information.

- Once approved, you'll receive a loan offer outlining the terms and conditions.

Interest Rates and Fees

Granite State Credit Union offers competitive interest rates on their loan products. These rates are subject to change based on market conditions and individual creditworthiness. Additionally, the credit union may charge certain fees, such as origination fees or late payment fees, depending on the loan type.

Factors Affecting Interest Rates

- Credit Score: Higher credit scores typically result in lower interest rates.

- Loan Type: Different loan products may have varying interest rates.

- Loan Term: Longer loan terms may come with higher interest rates.

Benefits of Granite State Credit Union Loans

Choosing a Granite State Credit Union loan comes with several advantages that set it apart from traditional banking options:

Member-Focused Service

As a member-owned cooperative, Granite State Credit Union prioritizes the needs of its members. They offer personalized service and work diligently to ensure members' satisfaction.

Lower Fees and Rates

Credit unions typically offer lower fees and interest rates compared to traditional banks. This advantage translates into significant savings for members over the life of their loans.

Community Involvement

Granite State Credit Union actively supports local communities through charitable donations and partnerships. By choosing their loan products, members contribute to these efforts.

Tips for Applying for a Loan

Applying for a loan can be a daunting process, but with the right preparation, it becomes much easier. Here are some tips to help you secure a Granite State Credit Union loan:

- Check your credit report for errors and address any issues before applying.

- Gather all necessary documentation, including proof of income and identification.

- Be prepared to discuss your financial goals and how the loan will help achieve them.

- Consider pre-qualifying for a loan to get an estimate of your borrowing power.

Member Testimonials

Hearing from satisfied members can provide valuable insight into the quality of service offered by Granite State Credit Union. Here are a few testimonials:

"I recently secured an auto loan through Granite State Credit Union, and the process was seamless. Their competitive rates and excellent customer service made it a stress-free experience."

- Sarah M., Member since 2018

"As a first-time homebuyer, I appreciated the guidance and support provided by Granite State Credit Union's mortgage team. They made the process easy to understand and helped me find the perfect home loan."

- John D., Member since 2020

Frequently Asked Questions

What types of loans does Granite State Credit Union offer?

Granite State Credit Union offers personal loans, auto loans, mortgage loans, and more. Their loan products are designed to meet a wide range of financial needs.

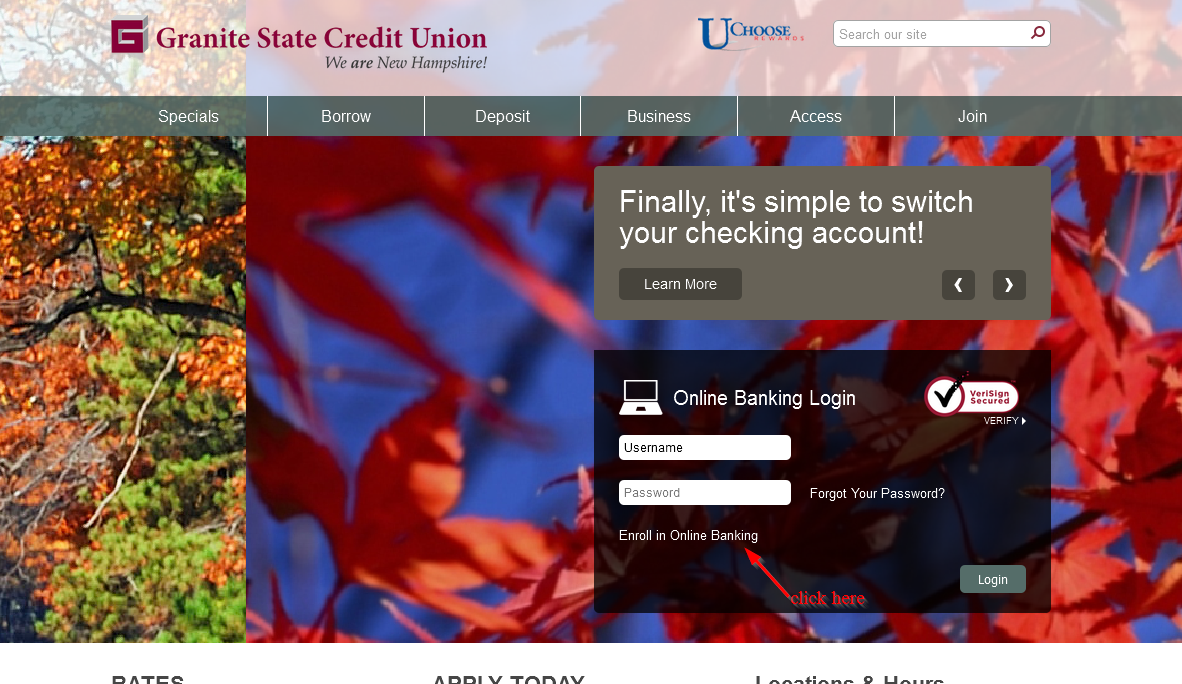

How do I apply for a loan?

You can apply for a loan online through the Granite State Credit Union website or by visiting a local branch. Be sure to gather all necessary documentation before starting the application process.

Do I need to be a member to apply for a loan?

Yes, membership in Granite State Credit Union is required to apply for a loan. However, joining the credit union is simple and open to eligible individuals.

Conclusion

In conclusion, Granite State Credit Union loan products offer a reliable and affordable solution for meeting your financial needs. With competitive interest rates, flexible repayment terms, and personalized service, they stand out as a trusted financial partner for individuals and families in New Hampshire.

We encourage you to take the next step by exploring the loan options available at Granite State Credit Union. If you have any questions or need assistance, don't hesitate to reach out to their friendly and knowledgeable staff. Share this article with friends and family who may benefit from these valuable insights, and consider leaving a comment below to share your thoughts.

For more information on financial planning and loan products, explore other articles on our website. Together, let's build a brighter financial future!